UPDATE: Register now for our February 23 webinar on "The Credit Union Entrepreneurial Ecosystem Challenge"

I was inspired by a TED Talk I saw that broke down a staggering challenge—saving bee populations—into everyone’s zone of control. By creating “fractured” ecosystems of wildflower patches in small spaces in your yard or a business’s parking lot green space, bees can move from one to the next and get what they need to survive.

This got me thinking, when you look around your community, you will likely see a variety of examples of entrepreneurship in action. This could include a neighborhood restaurant, a local manufacturing company or a small technology firm. On the surface, these companies look incredibly different. However, despite different sizes, growth aspirations, and industries, entrepreneurs and businesses all move through challenging stages of development and financial access—and all need support systems and safety nets to keep them running strong.

Credit unions have the opportunity to operate in their zone of control, too, serving the entrepreneurs in their communities, which links up to other credit unions in other communities and before you know it, there can be a thriving, nation-wide network of small businesses and entrepreneurs.

Entrepreneurial Stagnation

Entrepreneurship in the United States has hit the zeitgeist of America. Entrepreneurs grace the covers of magazines and are featured in new TV series, it seems weekly. The dual pandemics of COVID-19 and racial inequity, have directed our attention to support our local small business owners and there’s a surge of interest in doing more to help BIPOC owned businesses. It seems more and more of my friends have a “side hustle”—selling craft goods on Etsy, running an AirBnB or making money through YouTube channels or cryptocurrency projects.

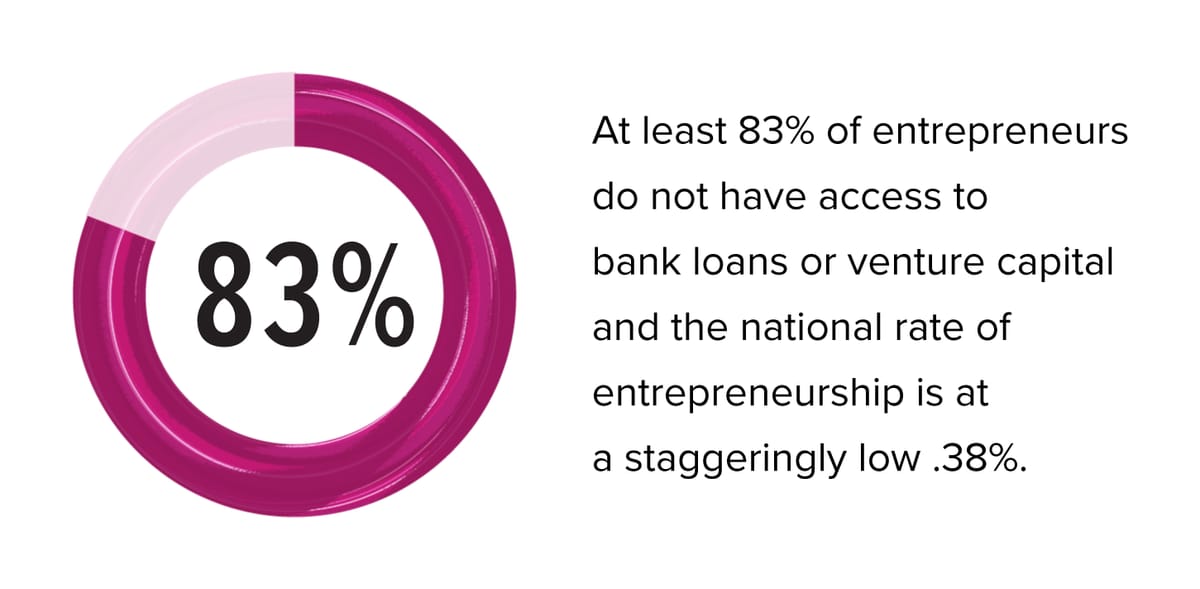

But despite our collective cultural fascination with entrepreneurship, the data tells a very different story. Although recent research shows that new and young companies are responsible for nearly 100% of net new job creation, America has been in a “startup slump” for a generation.

Andy Stoll, from the Ewing Marion Kauffman Foundation – one of the largest Foundations in the world focused on entrepreneurship – recently spoke at a Filene research event to share some sobering statistics (and explore with credit union leaders potential solutions).

“Despite the rising value and visibility, entrepreneurship, surprisingly, has been stagnant or declining over the last 30 years in every state,” Andy says. “Further, this kind of entrepreneurial stagnation has been linked to some of todays’ biggest challenges: the jobs deficit, slow productivity growth, stagnant wages and rising inequality.”

During the pandemic, we have seen an increase in the number of new entrepreneurs. Although this was positive to see, it appears a significant number of those entrepreneurs were starting new companies out of necessity since they couldn’t find other employment and needed to make ends meet.

The “startup slump” has further exacerbated barriers facing often underrepresented entrepreneurs. The challenges revolving around factors of race, gender and geography further limit full participation in business ownership, all of which were only made worse by the pandemic.

Despite immense efforts during the COVID-19 pandemic, entrepreneurs – the backbone of much of our communities and economy – still need more support and and access to opportunities to succeed. Without that, our communities and our country won’t reach their full economic potential.

Credit union leaders are already playing an essential role in these efforts, and doing so in ways that reach beyond our traditional role as capital providers to small businesses. Credit unions are finding new and innovative ways to take leadership roles in their local entrepreneurial ecosystem.

New Approaches are Needed

We know that entrepreneurs are economic and social drivers in our communities. They empower individuals, improve standards of living in the communities they serve, and create jobs, wealth and innovation in the economy.

Every individual that we can inspire, that we can guide, that we can help start a new company is vital to the future of our economic welfare.

In spite of this recognition around the importance of a strong, growing entrepreneurial community, when it comes to supporting entrepreneurs in practice, many leaders are unsure how they can make a real impact. Traditional methods of helping entrepreneurs that have been practiced for decades (incubators, investment funds, mentoring programs) are not enough, by themselves, to overcome all of today’s challenges. We have to develop new ways to get all of those programs to work better together in support of local entrepreneurs.

Despite the numerous positive effects of entrepreneurship, most regions do not have a strongly articulated and widely understood strategy to support entrepreneurs. Compounding these problems, entrepreneurs from rural communities, immigrants and those who identify as women, LGBTQ+, and people of color are seeing unprecedented challenges during the ongoing pandemic and still face significant barriers to finding entrepreneurial success.

An Inclusive Entrepreneurship Ecosystem Takes Time

Entrepreneurs generate two-thirds of new jobs while also providing a crucial path to economic and social stability as well as wealth-building possibilities for many Americans. However, Black, Indigenous, people of color, women, LGBTQ+ and other marginalized groups are often excluded from the opportunity to start and grow a business.

Eighty percent of white business owners receive at least a percentage of the funding they request from a bank. Only 66.4% of BIPOC (Black, indigenous, or people of color) business owners can say the same. When BIPOC-owned firms do get funding, the amounts tend to be about $30,000 less than comparable white-owned businesses, while their interest rates are about 1.4% higher.

Entrepreneurship provides one of the main modes of upward mobility for BIPOC Americans who have been historically excluded from capital and institutions and/or systematically disadvantaged in their efforts to start a business, save, and build wealth. The system of support needs to change.

Entrepreneurial Ecosystem Building

In response to these challenges, entrepreneur-focused economic development has been emerging over the past few decades. A key component of this is often referred as "entrepreneurial ecosystem building,” Ecosystem building asks us to consider the whole system of support across our communities and how all those “parts” work together. Everyone in a community can play a part in helping entrepreneurs. We just need to do a better job at working together.

The growing professional practice of ecosystem building centers around fostering more connections, collaboration, and a robust, more inclusive network of support for entrepreneurs across an entire community. Given the various dimensions and participants that create and strengthen ecosystems—credit unions are needed. Credit unions have a responsibility to their communities; they are, after all, considered “anchor institutions” that have been specifically designed for the area, community and those they serve. I like to think of it as credit unions being the ones that plant the wildflowers where they can to create the ecosystems in which our entrepreneurs can thrive!

Credit unions have a responsibility to their communities; they are, after all, considered “anchor institutions” that have been specifically designed for the area, community and those they serve.

There has been steady growth in overall business lending by credit unions. Over the past three decades, the percentage of credit unions offering business loans over $50,000 and the amount of those loans has grown. Nonetheless, it is clear that there is an opportunity for credit unions and other community-oriented financial institutions to do even more.

Credit unions are discovering new ways to be innovative when supporting entrepreneurs and small business owners. Changes at the national level are allowing credit unions to deploy more financial capital and provide gap financing and bridge loans. There are always opportunities to develop new and better ways for entrepreneurs to access safe and affordable and flexible capital.

Build an Entrepreneurial Ecosystem

If your credit union doesn’t know where to begin, consider these five ideas:

- Buy from your local small businesses. Instead of ordering your bulk supplies, kitchen snacks, or staff appreciation gifts from an online conglomerate, find a local vendor who can fill those roles. When you consider how money recirculates within your local economy, it’s a net positive and it offers a local, personal touch. You have a choice in where you buy your “wildflower seeds” to plant!

Data shows that local retailers return 52% of their revenue back into the local economy, compared to just 14 percent for national chain retailers. Money circulating through the local economy benefits everyone who is a part of each transaction.

- Convene and connect entrepreneurs, and those who support them – think about this as a thriving bee colony. Champion entrepreneurs and their role in local economies and be an onramp into the community’s entrepreneurial ecosystem. Host lunch ‘n learns, after hours networking, or an education series on finance strategies.

- Advocate for entrepreneur-friendly policies. Credit unions can be nimble in rising to the needs of its local entrepreneurs. Finance a revolving loan program with your local government, offer service hours to sit on a local financial review board, or create a matching fund for public financing incentives. In other words, make sure you’re focused on providing the best kind of flowers you can for the bees.

- Sponsor and fund local ecosystem builders and entrepreneurship support efforts. Many communities have business challenges, pitch-fests, or accelerated programs to owning a business. Use your cause-related marketing dollars to sponsor their work and elevate their awareness in the community.

- Sponsor and fund local ecosystem builders and entrepreneurship support efforts. Many communities have business challenges, pitch-fests, or accelerated programs to owning a business. Use your cause-related marketing dollars to sponsor their work and elevate their awareness in the community.

- And of course, financing. Almost all new businesses, or business owners who want to reach the next level, need affordable and flexible capital to take the next step. Financing, whether to start or expand, is the leading challenge that almost all new and small businesses face. Explore revenue-based financing, loans with flexible repayment terms, and innovative ways to help entrepreneurs purchase property or equipment. For entrepreneurs who are BIPOC, LGBTQ+ and women, set aside a meaningful portion of your entrepreneurial ecosystem building commitment to specifically help those businesses grow.

- Sponsor and fund local ecosystem builders and entrepreneurship support efforts. Many communities have business challenges, pitch-fests, or accelerated programs to owning a business. Use your cause-related marketing dollars to sponsor their work and elevate their awareness in the community.

Working with entrepreneurs and entrepreneur ecosystems allows us to better understand what factors and processes need to be in place to achieve long-term, sustainable change. By deepening our understanding and engagement as an industry, we can help our local communities rebuild the economy while allowing small businesses owned by minority entrepreneurs to thrive. If you agree, consider implementing these ideas and share with me how it’s going, and don’t forget to share with other credit unions so these ideas can spread – buzz, buzz, buzz!