Credit unions have unique opportunities to build trust and drive impact by leveraging social media to attract the next generation of members and employees, strengthen relationships, build trust, and enhance loyalty. This report outlines three core strategies for success that credit unions can use in understanding the next generation’s expectations: prioritizing authenticity, reflecting their audience, and encouraging meaningful interactions.

Quick Notes / TL;DR:

Credit unions have unprecedented opportunities to build trust, connect authentically, and drive business impact through social media, particularly when trying to reach, attract, and engage their next-generation members.

Core to success, credit unions must lay a solid strategic foundation for social media usage. This is most often found at the intersection of understanding a younger audience’s wants, needs, and expectations on social media and the credit union’s values, brand, and authentic voice. This provides a fertile ground for engagement on social platforms as younger individuals engage more rapidly and repeatedly with social content if they sense it is authentic, valuable to their lives, and helps them see themselves in the brand at hand.

What’s more, credit unions can consider ways to drive co-creation and foster two-way conversations to catalyze even deeper social following and loyalty, both of which have been researched as viable pathways to engagement with a brand’s products and services.

The Challenge at Hand

In today’s fast-paced social media landscape, credit unions face a unique challenge: staying relevant to attract next-generation members while also staying true to their community-centered roots, all with limited time and resources.

The strategies shared in this brief include actionable guidance to help credit unions understand the value of prioritizing social media, the best ways to navigate social media trends, and turnkey ways to connect authentically with younger audiences, ultimately leveraging social media as a key tool for growth.

The Case for Social Media

Social media is not just about trends; it’s about creating a space where trust and authenticity thrive. Platforms act as modern word-of-mouth, including for financial institutions, providing social proof and validating consumer choices, particularly when thinking about younger consumers.

The three data points below represent just a small fraction of a growing body of research supporting social media as a key “validator” for consumers and jobseekers in their research processes, but together underscore the platforms’ importance in multiple aspects of business strategy.

Three Core Strategies for Social Media Success

#1. Authenticity Over Everything

In a world of polished marketing, authenticity is the true differentiator, particularly to a younger generation that actively seeks it. Younger generations have repeatedly stated that they seek brands and institutions they perceive to be more “real” on digital channels because they see engaging with them as a reflection of themselves.4 People trust brands that feel genuine and human.

A few tips on how credit unions can prioritize authenticity when crafting social media strategies, content calendars, and more:

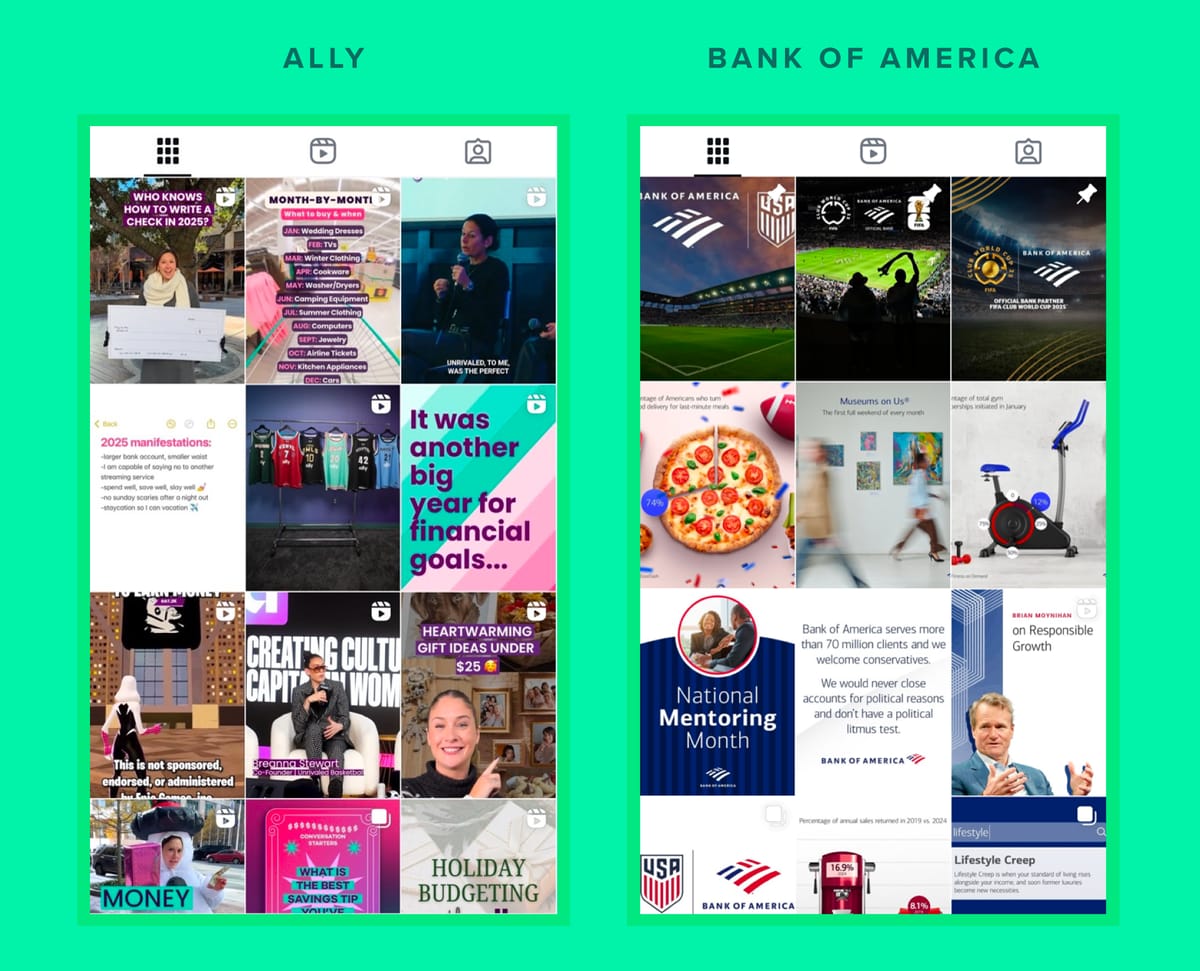

Showcase real people—employees, members, and community voices. Ally Bank, for instance, uses real-life, unpolished, person-on-the-street interviews and relatable content on their Instagram channel (sometimes financially-based, other times culturally of-the-moment).5 This strategy helps them to outperform and capture much higher engagement than larger competitors like Bank of America (299k followers), even with a significantly smaller following (57.6k followers).6

Balance polished imagery with real-life moments. There are a lot of ways to do this, and one includes sourcing content (e.g., photos, videos) from members and followers themselves. Leveraging this user-generated content for actual social posts is another great way to create a relatable social narrative that resonates more than perfect, staged visuals.

Write captions as though speaking directly to members. People love people, and you want to write like one, not a robot! Think about your brand’s core values and voice. What would you sound like if you were a person on the street? Avoid jargon, ask questions, and don’t be afraid to use emojis. All told, a winning social media voice focuses on a conversational, compelling tone as a means to most effectively get a message across.

- Pro tip: AI can help with this! Struggling to write a caption? Upload a draft into your paid ChatGPT account (or another AI tool) and ask it to make your caption more personal, conversational, and relatable to Gen Z.

See if you can spot the differences between Ally Bank and Bank of America’s Instagram content:

TO DO

- Audit your social media channels to identify opportunities for more authentic storytelling.

- Include user-generated content and behind-the-scenes glimpses of your credit union where possible.

- Train your team—or your AI tools!—to write captions that sound human and relatable with your brand guidelines baked in.

#2. Be a Mirror, Not a Door

A key to driving audience engagement and growth on social platforms is helping people to see themselves reflected in your brand’s presence. This is supported by Robert Cialdini’s age-old principle of persuasion: social proof. Cialdini’s research proved that people are drawn to things experienced by people they perceive to be similar to themselves.7 For social media strategy, this means featuring diverse voices, real people, and experiences that align with your community and will resonate with those you are trying to attract.

An example of success in this space comes from higher education—institutions that also must reach, attract, and engage Gen Z-ers on social media.

Boston College has won numerous awards for their social media strategy and execution and excels at being a mirror to their audience.8 They give people many “peeks behind the curtain” with “day in the life” vlogs, “ask me anything” days, alumni career videos, and dorm tours. Showcasing these many touchpoints with diverse students, alumni, faculty, and staff helps viewers on the other side of the content find something they can relate to and see people or perspectives in line with their own.

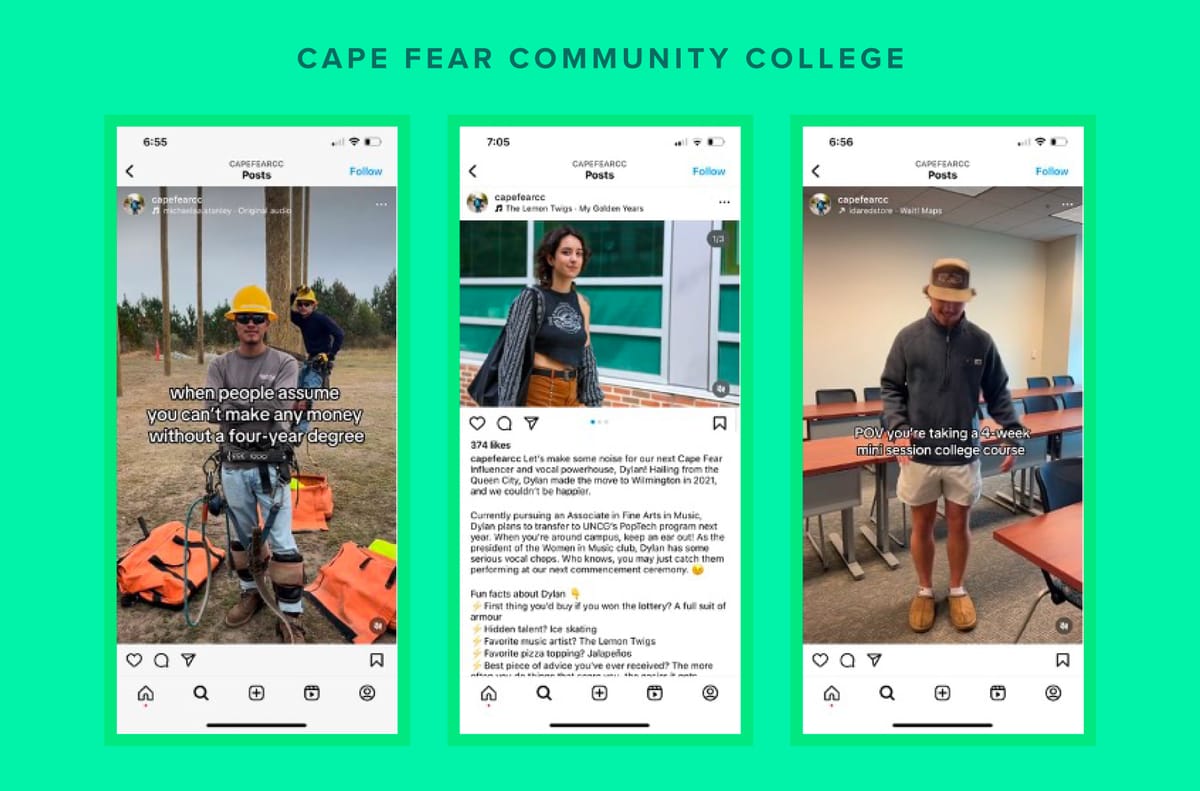

Cape Fear Community College is another great example of a higher-ed institution bringing the faces and experiences of Gen Z to life with their content.

Ways to help your audience see themselves in your social:

Highlight community events, member stories, and employee spotlights with videos featuring real people. These videos don’t have to be perfect—shoot them on iPhone, make sure the audio is decent, and ensure you aren’t featuring just one type of person or voice.

Use diverse visuals and topics to appeal to a broad audience. Think about life stage content, for example; you want to ensure you aren’t just speaking about retirement, but also about younger generational topics like “post–vacation spending scaries,” wedding planning, and saving for a first home. Having people from the life-stage demographic (members or employees) speak to these topics on your platforms is even more impactful.

Make it a simple habit to regularly ask yourself and your teams, “Does this content truly reflect the people we serve and hope to reach?”

TO DO

- Sketching out a content calendar is a great way to ensure you’re being a mirror and not a door. Start by looking at one quarter and brainstorm topics and real people that could bring these topics to life on your channels. Then, step back from the trees and see the forest. Are there enough diverse perspectives? People? Life stages? Topics?

- When bringing your content to life, try using different formats, some of which might be a bit more authentic and real, like Q&As with current next-gen members or takeovers with next-gen employees.

#3. Foster Conversations and Co-Creation

Social media thrives on dialogue, not monologue, yet it is tempting when cultivating a social presence to lean into the many things that as a brand, we want to talk about: our products, services, community involvement, and more.

Some of this, of course, is good and important as it builds our brand. However, the real “stickiness” to social media comes when viewers are prompted to participate. This signals to them that their voice is not only heard, but valuable, and, that their voice can shape the experience and offering the brand promotes.

In addition, keeping the conversation going on social media and truly listening to those taking the time to engage is also important. This is called community management. This additional layer to social media strategy ensures comments are monitored and responded to, those who are engaging feel validated, and ideas are cultivated from the community itself.

A Breakdown of These Key Approaches:

This approach is all about inviting members in. Examples include user-generated prompts (e.g., submit “X” to us, tell us “Y” about what makes credit unions special), polls and voting (e.g., tell us which of these topics you’d like to hear about next, vote on new products we’re thinking about that are most interesting to you), and member takeovers (e.g., let a member steer the wheel / content for a day).

This approach is all about talking to your community and ensuring they feel heard. Proactively engage with comments, messages, and posts. Brands like Glossier excel by responding thoughtfully to their audience while creating a sense of belonging along the way.9

TO DO

- Launch a member-driven campaign that encourages sharing stories or photos related to their credit union experience.

- Dedicate resources to actively monitor and respond to social media interactions. This doesn’t have to be a major time commitment. Typically, 30 minutes a day or an hour every other day will do.

- Collaborate with community micro-influencers to amplify your message and catalyze more co-creation.

Ways to Think About Measuring Success | ||

|---|---|---|

Engagement | Track likes, comments, shares, and direct messages. Rises in any or all of these signal deepen traction with your audience. | |

Sentiment | Monitor how people talk about your brand online with a social media management platform like Sprout Social. Ensure you benchmark your “before” stats and then measure at 3-month, 6-month, and 1-year marks to see any progress you’re making with amplifying positive and reducing negative brand sentiment. | |

Conversion | Measure how social media drives specific actions, like visits to your website or clicks to promoted products, services, events, and more. Ensure you’re also asking new members how they heard of you, breaking out your various social channels individually to track how social media is funneling new member leads. | |

Retention | Ask current members whether they follow you on social media and track it in your CRM. Assess whether active members who are social media followers have stronger loyalty and retention to your credit union compared to those who do not. |

Bringing It All Together

By focusing on authenticity, reflecting your audience, and fostering meaningful interactions, credit unions can use social media to attract new members and employees, strengthen relationships, build trust, and drive loyalty. Remember, social media isn’t just a tool for broadcasting—it’s a space for connection and co-creation.

If Nothing Else, Make Sure You and Your Teams are Discussing These Top Five Questions:

- Who in our community or member base should we feature more prominently?

- Are our visuals and voice aligned with the people we want to reach?

- How can we encourage more two-way conversations with our audience? Do we know what our audience really wants to hear about?

- What content formats (e.g., video, stories) resonate most with our members based on the performance of our posts? How can we create more?

- Are we consistently reflecting the sweet spot of our values, or mission, and what our target members want to hear about in what we post?

Endnotes

- Roger Horberry, “Must-Know Social Media Statistics for 2024,” GWI, accessed January 6, 2025, https://blog.gwi.com/marketing/social-media-statistics/.

- Jacqueline Zote, “Instagram Statistics You Need to Know for 2024,” Sprout Social, February 22, 2024, https://sproutsocial.com/insights/instagram-stats/.

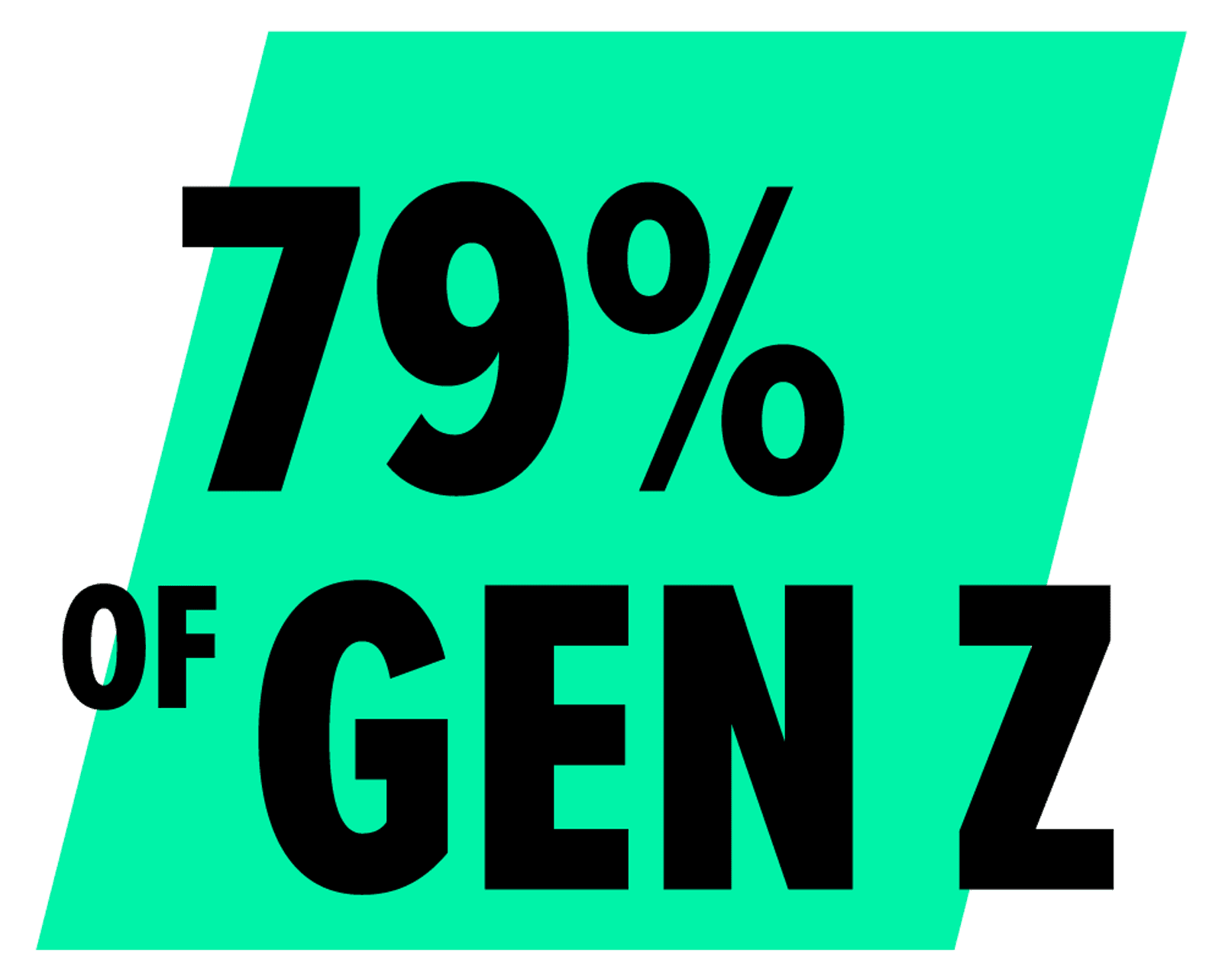

- PYMNTS, “79% of Millennials and Gen Z Turn to Social Media for Financial Advice,” PYMNTS, October 14, 2024, https://www.pymnts.com/consumer-finance/2024/79percent-of-millennials-and-gen-z-turn-to-social-media-for-financial-advice/.

- Wilson, Sara. "Where Brands Are Reaching Gen Z." Harvard Business Review, March 11, 2021, https://hbr.org/2021/03/where-brands-are-reaching-gen-z.

- Ally Bank, @ally, https://www.instagram.com/ally/.

- Bank of America, @bankofamerica, https://www.instagram.com/bankofamerica/.

- Cialdini, R. B. (1984). Influence. New York: William Morrow and Company.

- Boston College, @bostoncollege, https://www.instagram.com/bostoncollege/?hl=en; @bonstoncollege, https://www.tiktok.com/discover/boston-college?lang=en.

- Glossier Inc, @glossier, https://www.instagram.com/glossier/?hl=en, @glossier, https://www.tiktok.com/@glossier?lang=en.