Executive Summary

Data analytics has been on the agenda of credit union leaders for much of the past decade. These leaders have wrestled with issues related to how data analytics could create value in their organization, challenges around managing and using data responsibly, and fairness around artificial intelligence technology. This report describes the data analytics value proposition for credit unions and begins the work of the Center for Data Analytics to facilitate effective credit union system data analytics use by providing key approaches, insights, and future directions.

What is the research about?

Data analytics marks a distinct change from the traditional manner in which financial services providers have made use of their data. The most important change that data analytics brings to a credit union is the emphasis on leveraging data to predict the future. Analytical platforms that predict what is likely to occur across an array of credit union processes, products, and members are very different from the traditional processes of analyzing data to report the past.

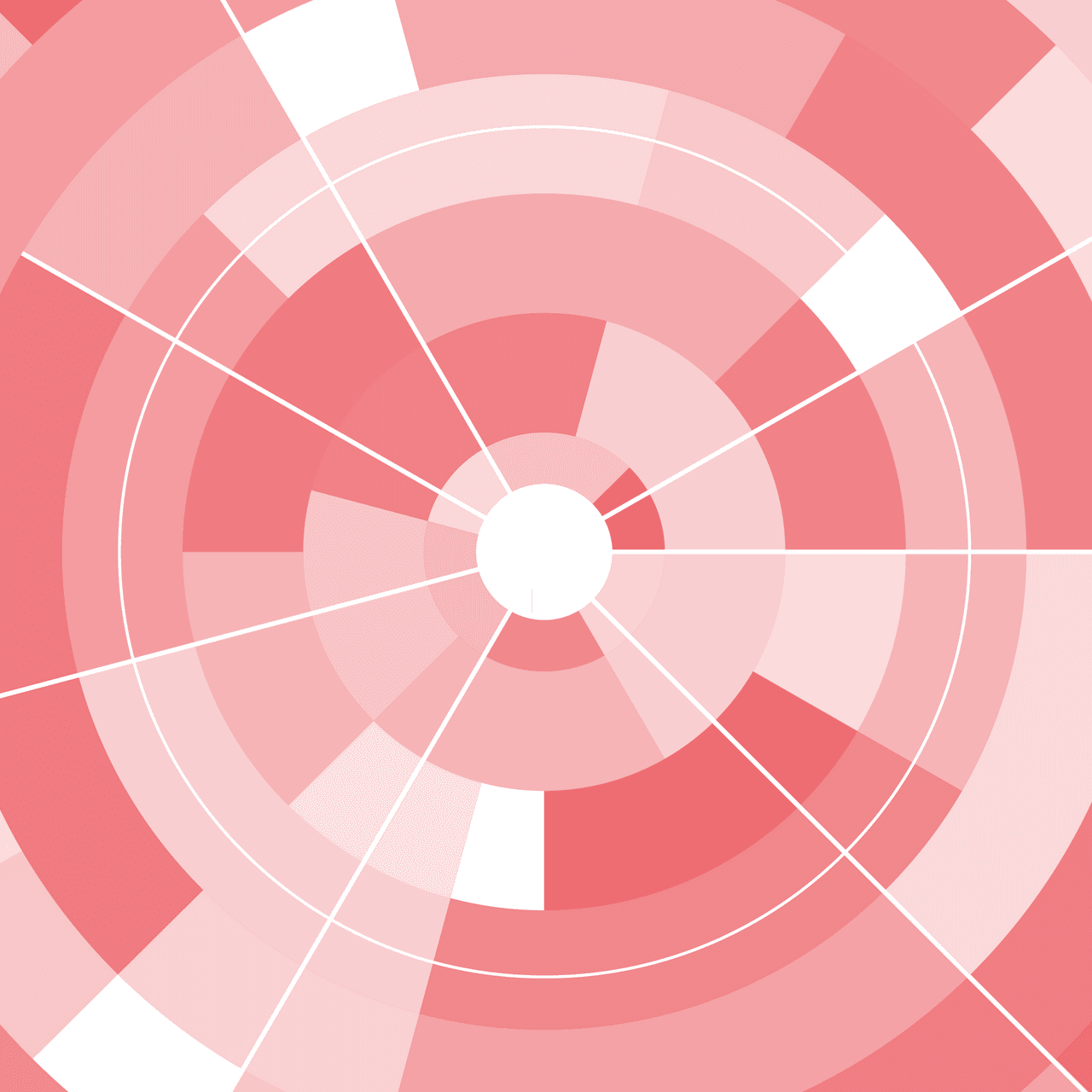

This report reviews key concepts and proficiencies for leveraging analytics in credit unions. An ecosystem framework is developed to surface internal and external credit union capabilities that will best position credit unions for extracting insight from data analytics. Primary internal capabilities include:

- Data management and governance

- Human capital

- Data-informed cultures and change management

- Leadership and organizational support

These internal capabilities can be strengthened by a range of external partnerships available to credit unions as they build a wider analytics ecosystem to maximize value creation. In addition, key elements focused on the responsible use of data and data analytics are reviewed and direction is provided as credit unions plot their analytics journeys.

What are the credit union implications?

With the increased volume and variety of data, most credit unions find themselves data rich but information poor as efforts are put forward to manage and then meaningfully analyze their data assets. The movement in credit unions toward more data-driven business models requires strategic guidance to ensure that priority opportunities are addressed and that the analytics journey moves forward as efficiently as possible. To facilitate the adoption of data analytics, credit unions should endeavor to build internal capabilities while identifying appropriate third-party relationships to further enhance their ability to develop and leverage insights. Regardless of where your credit union’s culture, leadership, and capabilities are today, you can begin developing your organizational capacity to make use of analytics with incremental steps:

- Begin a culture shift: Stress the importance of moving toward a data-informed culture. Create and model the expectation of data-informed decision making.

- Use analytics to create value quickly: Review your business plan and identify significant opportunities or problematic pain points where analytics could provide insight. Leveraging data analytics to address these types of issues first can help kick-start value creation and facilitate wider adoption across the credit union.

- Build your foundation: Focus on developing internal readiness. Build your human, technical, and systems infrastructures to increase capabilities. Where does your credit union already have capacity? Where is additional development needed?

- Leverage external partnerships: Partnerships are becoming increasingly critical for credit unions to create deeper member engagement. Take advantage of external analytics ecosystem partners to broaden your data analytics scope and extend your reach.

While it may be tempting to begin with your credit union’s grand challenge, it can be more effective to capture some quick wins with smaller yet compelling priorities so that the organization gains an appreciation for the potential value of analytics outcomes. This “bite-size chunk” process helps reinforce and accelerate the transition toward a data-informed culture across the credit union.