Executive Summary

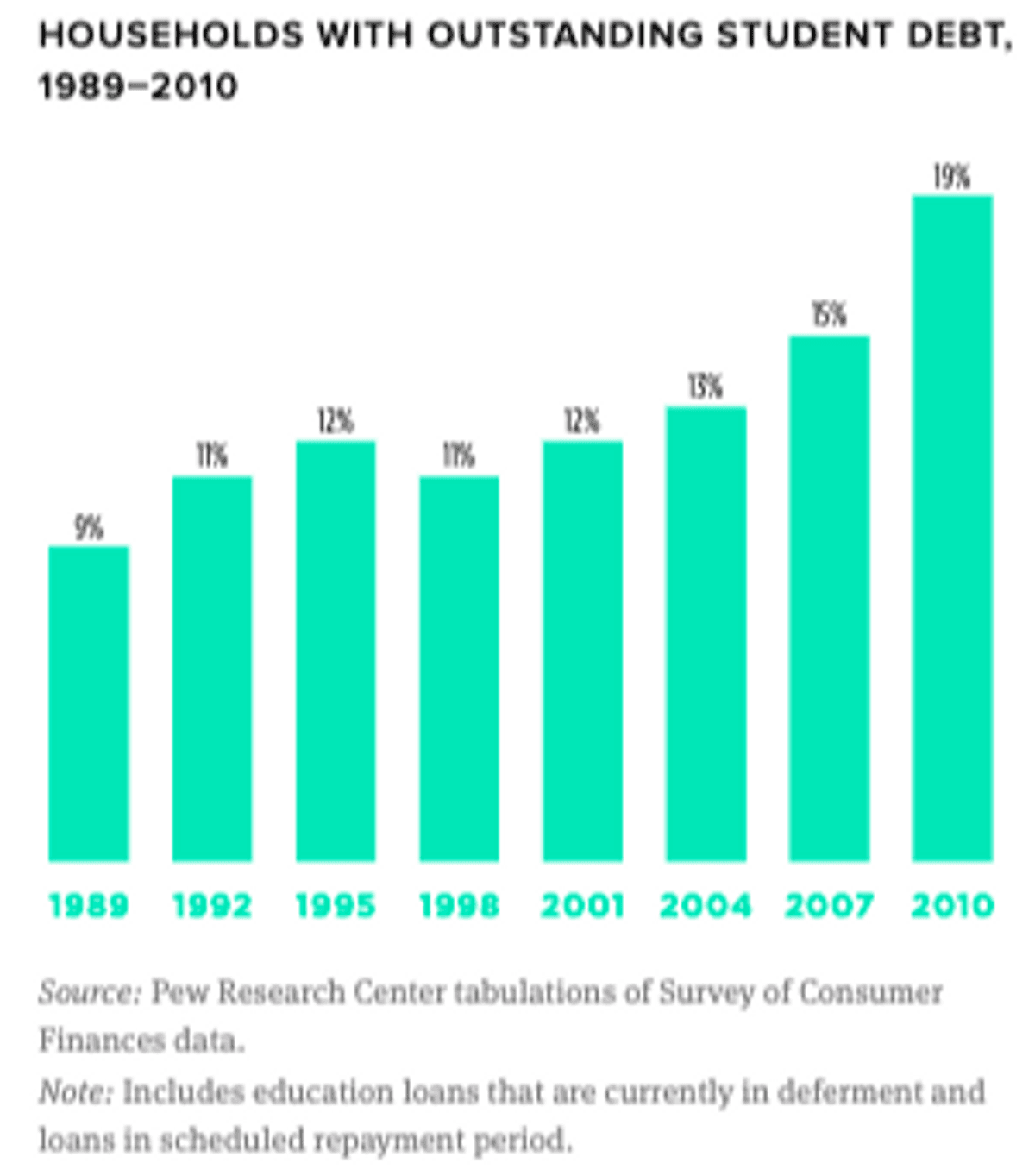

Graduating from college is one of life’s great milestones. It marks the end of one chapter and the beginning of another. It validates all of the late-night study sessions, research papers, and two-hour midterm exams. College graduation brings joy. It also comes with a price—a very expensive one. This is especially true for those students who rely on loans to finance their college tuition, books, and housing. In fact, the average borrower will graduate with $26,600 of student debt.

College graduates are better positioned to earn more over their lifetime than those with high school diplomas, but the steep costs of attending college have dissuaded many from pursuing higher education. College tuition costs are rising, the unemployment rate for new graduates remains high, and many Americans are at risk of defaulting on their student loans. Absent scholarships or grants, it’s hard for the average middle- income household to avoid the financial pitfalls of college.

What is the research about?

Both federal and private student lending programs expand access to college. Federal loans remain safe options for students because of their fixed interest rates and flexible repayment terms. Unfortunately, since federal loan programs don’t require a credit check, they are susceptible to fraud and mismanagement. Students aren’t held accountable on where and how this money is spent, creating opportunities for misuse and abuse.

On the other hand, a strong credit score can help a student receive favorable private student loans. Private loans have variable interest rates, but many financial institutions have loan reduction contingencies that reward students for good grades. Credit unions are playing a central role in helping students get the financial assistance they need for college. In addition to lending, credit unions have so much more to offer students who are preparing to attend college. It starts with education that helps students become fully aware of their options.

This report aims to give an overview of what credit unions are doing to help finance college education, the opportunities available to credit unions to provide structured private lending options, and how this current financial burden on graduates is affecting big life choices. The report includes examples of credit unions that are currently offering attractive loans to undergraduate students and consolidation services for graduate students.

What are the credit union implications?

Credit unions need to focus on being more than an afterthought in student lending conversations. Credit unions have tremendous opportunities to offer students need-based lending. Moreover, the presence of cosigners can help minimize risk to lenders associated with private loans. Not only does responsible lending build member satisfaction, but it helps nurture positive relationships with the members of tomorrow. Students can breathe a little easier knowing they won’t be ambushed with any surprises after graduation. Transparency is essential.

Individual credit unions, especially those close to a university, have built their own programs, but easy-to-access CUSOs have made entering the market easier than ever. Different models have emerged, making it fairly simple to offer loans from $2,000 to more than $150,000.

Student lending may offer only modest initial gains or revenue to most credit unions, but it can serve as a long-term engine for growth. Law-makers and the Consumer Financial Protection Bureau continue to monitor student debt and are exploring solutions for reforming the system. Regardless of that outcome, credit unions can act responsibly to help students realize their dreams of attending college without having to break (or go to) the bank.

Title supporter of The Cooperative Trust