Executive Summary

Domestic violence (DV) is a widespread problem, affecting millions of people in the United States annually (Tjaden and Thoennes 2000). Limited financial resources is one of the primary reasons survivors remain in or return to abusive relationships. A recent study of callers to the National Domestic Violence Hotline found that 73% of callers stayed longer in an abusive relationship than they wanted to because they were concerned about financially supporting themselves and their children (Adams and Littwin 2016). Abusers foster economic dependence by preventing their partner from working, restricting their access to money, stealing their money, hiding financial information, and generating debt in their partner’s name, among other economically abusive tactics (Adams et al. 2008).

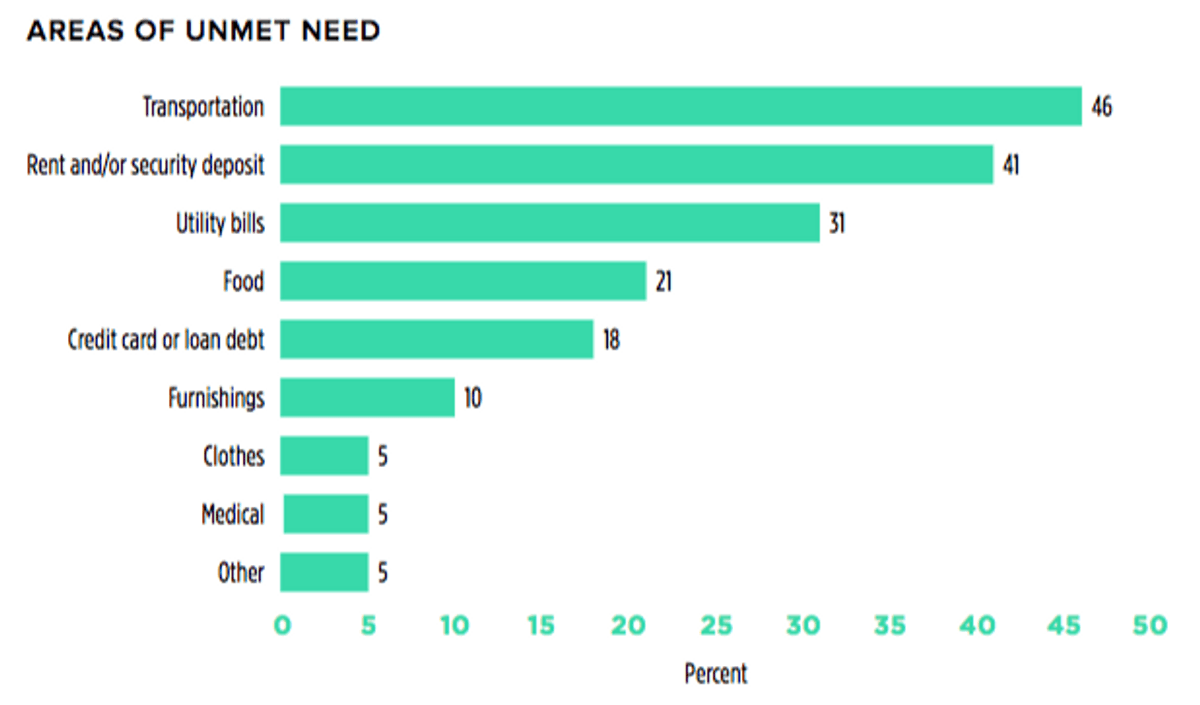

Research shows that the more economic abuse survivors experience, the more they struggle financially (Adams et al. 2008; Adams, Beeble, and Gregory 2015; Adams et al. 2012). With no money for even basic necessities and outstanding debt, leaving the abuser often means facing compounding conditions of poverty or homelessness (Davis 1999; Goodman et al. 2009). Further, the financial consequences can last for years after the abuse ends (Adams et al. 2012; Adams et al. 2013).

What is the Research about?

The Domestic Violence Recovery (DVR) Loan program was designed to provide survivors of abuse with an affordable option for removing financial barriers to safety and/or rebuilding after an abusive relationship. This report details the development of and initial findings from the implementation of the DVR Loan program from May 2014 through May 2016. Data sources include a survey of survivors, interviews with key informants (DV survivors, DV advocates, and credit union representatives), participant observations, and program records.

The report is organized into three chapters:

- A description of the impetus for the program and the program development process.

- The current program structure and processes, and descriptions of the first eight loans granted.

- Key lessons learned and next steps for the program.

What are the credit union implications?

During the development of the DVR Loan program, several important lessons emerged that are instructive for other communities considering launching a similar program:

- The credit union must have the risk tolerance to offer a low- interest loan to people with unfavorable credit histories; it should be willing to approach the project as a service opportunity rather than a money- making venture. The first credit union involved in the project was hesitant to offer a low interest rate, while another was comfortable moving forward with a lower rate knowing there would be grant funding to cover 30% of the losses.

- Designing and implementing a DVR Loan is faster and more efficient if the credit union representative with decision- making authority around the design and implementation of the product is at the table.

- Financial education may be an integral part of a successful loan. But make sure that the added responsibility of providing multiple hours of one-on-one financial education does not overburden the DV advocates.

- Survivors must receive detailed information about the program at the outset to allow them to make an informed decision about whether to proceed with the financial education component of the program. A client information sheet detailing the aims, eligibility criteria, and application process provides clients with clear information and deters plainly unqualified clients from going through the full application process only to be denied the loan.

- A program operating solely through the collaboration of multiple organizations requires centralizing features. During the development phase, the working group served as that centralizing feature; once the program was launched, the pre-qualification committee served that function.

The DVR Loan answers a clear and present need in most communities. It represents a tangible opportunity to serve a severely underserved community and live out the people- helping-people ethos of credit unions.