Executive Summary

The Domestic Violence Recovery (DVR) Loan program launched in 2014 through the collaboration of six organizations serving domestic violence (DV) survivors in a tri-county area of mid-Michigan, the Michigan State University Federal Credit Union (MSUFCU), and Adrienne Adams, the principal investigator. This program set out to devise a loan product to meet the needs of DV survivors, especially the need for immediate social and financial support after separating from an abusive partner.

What Is the Research About?

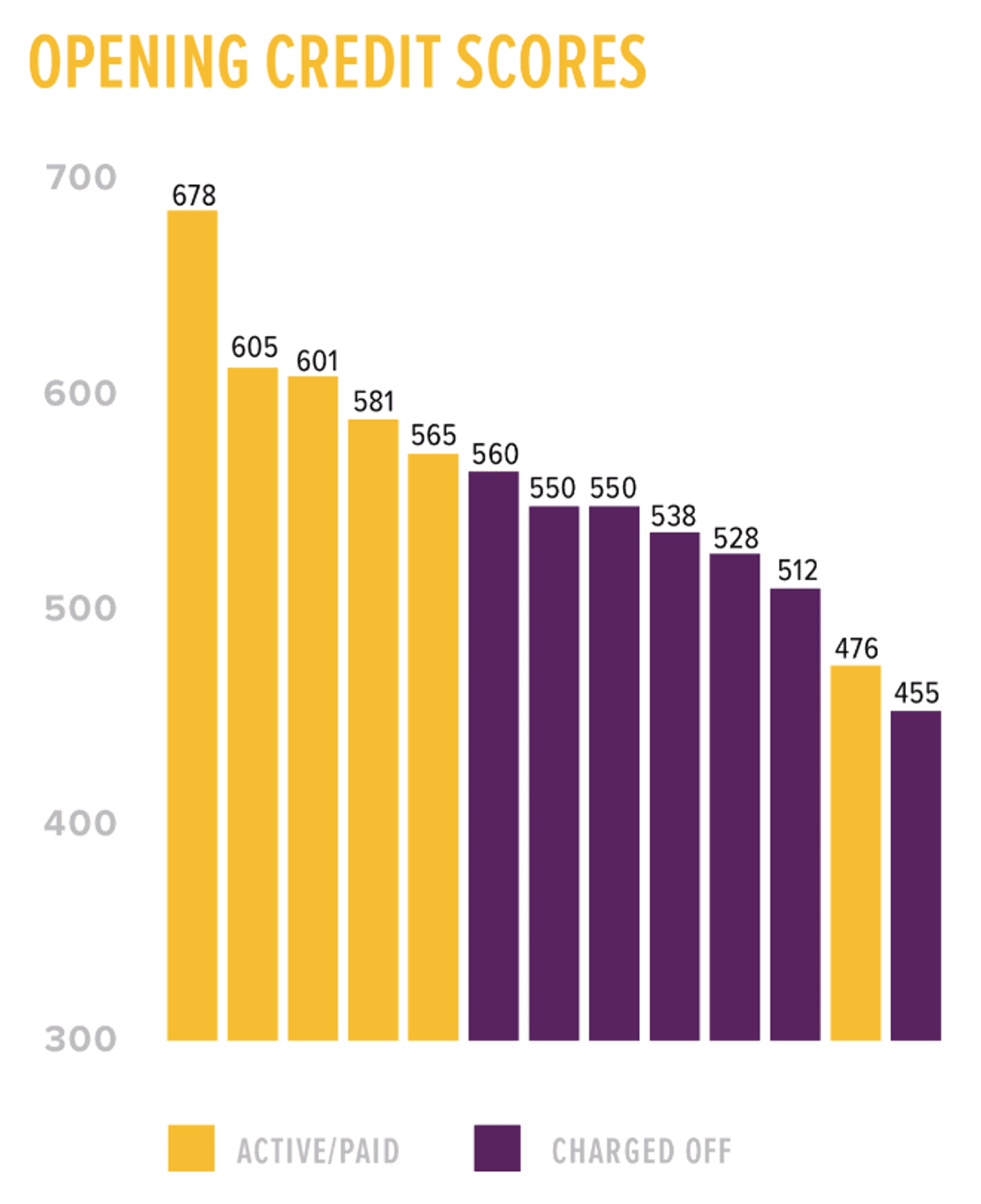

This report provides results of the second iteration of the DVR Loan program, building on a previous interim report (Adams 2017). The initial DVR Loan program (1.0) provided loans up to $2,500 to survivors of DV, without the need for credit scores. Borrowers were provided the entire loan amounts to meet safety-related needs, granted repayment terms of up to 60 months, and were allowed to receive the funds through a third party to protect those funds from potential abuser interference. The hope was that in lieu of traditional measures of creditworthiness, partnering DV advocates would be uniquely positioned to make a holistic assessment of borrowers’ likelihood of repaying.

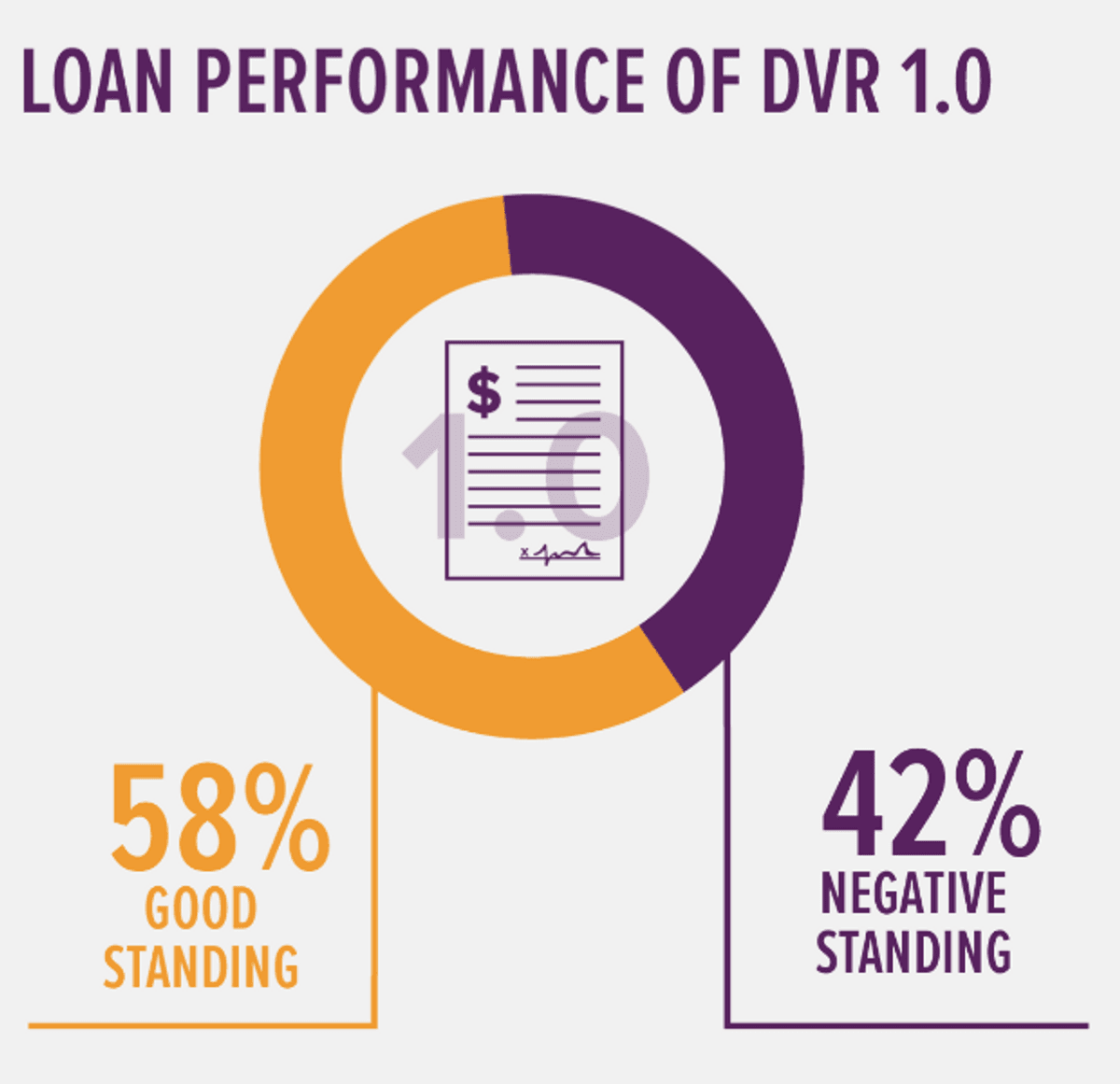

From November 2015 through August 2016, 16 DV survivors applied, and 12 loans were made. This resulted in 58% of borrowers’ loans in good standing, but 42% of the loans were delinquent and one had been charged off. Because of concerns over the high delinquency rates, lending was suspended until modifications could be made that might improve loan repayment. Specifically, analysis suggested that borrowers’ reported income did not adequately reflect their actual income and that the loan may not have been affordable to begin with. There was also evidence that borrowers’ financial situations unexpectedly declined after receiving the loan. Finally, ineffective financial management practices were suspected of affecting low repayment rates.

A second iteration of the DVR Loan (2.0) was launched with several adjustments, including a six-week schedule for the financial education curriculum administered by trained DV partners. This component required candidates to complete a four-week spending tracker that was utilized by the pre-qualification committee in evaluating the creditworthiness of the borrower. Loan candidates were also asked to provide explanations for their negative credit histories, including how abusive partners had affected their credit. Finally, borrowers were required to meet monthly with partnering DV advocates throughout the repayment period to monitor repayment status and receive financial counseling and support.