Risk, Regulation and Compliance for ITIN Lending

Miriam de Dios Woodward, CEO of ViClarity, explores the risks, regulations and compliance considerations related to ITIN Lending.

Refer to page 6 of your User Guide.

Online Learning Content Presentation: Risk, Regulation and Compliance for ITIN Lending

This presentation explores account opening procedures (including use of acceptable IDs), relevant lending policies and procedures (including the Equal Credit Opportunity Act), how to avoid unclear advertising and loan terms, and identity theft red flag rules. In addition, the presentation reviews best practices on engaging examiners and other regulatory entities.

Risk Evaluation Exercise

This tool helps you conduct an internal review of the risks your financial institution should consider when implementing ITIN Lending, and provides elements to use in evaluating those risks.

ITIN Lending Implementation Guide

Download the free, research-based implementation guide to help your financial institution implement an ITIN Lending program.

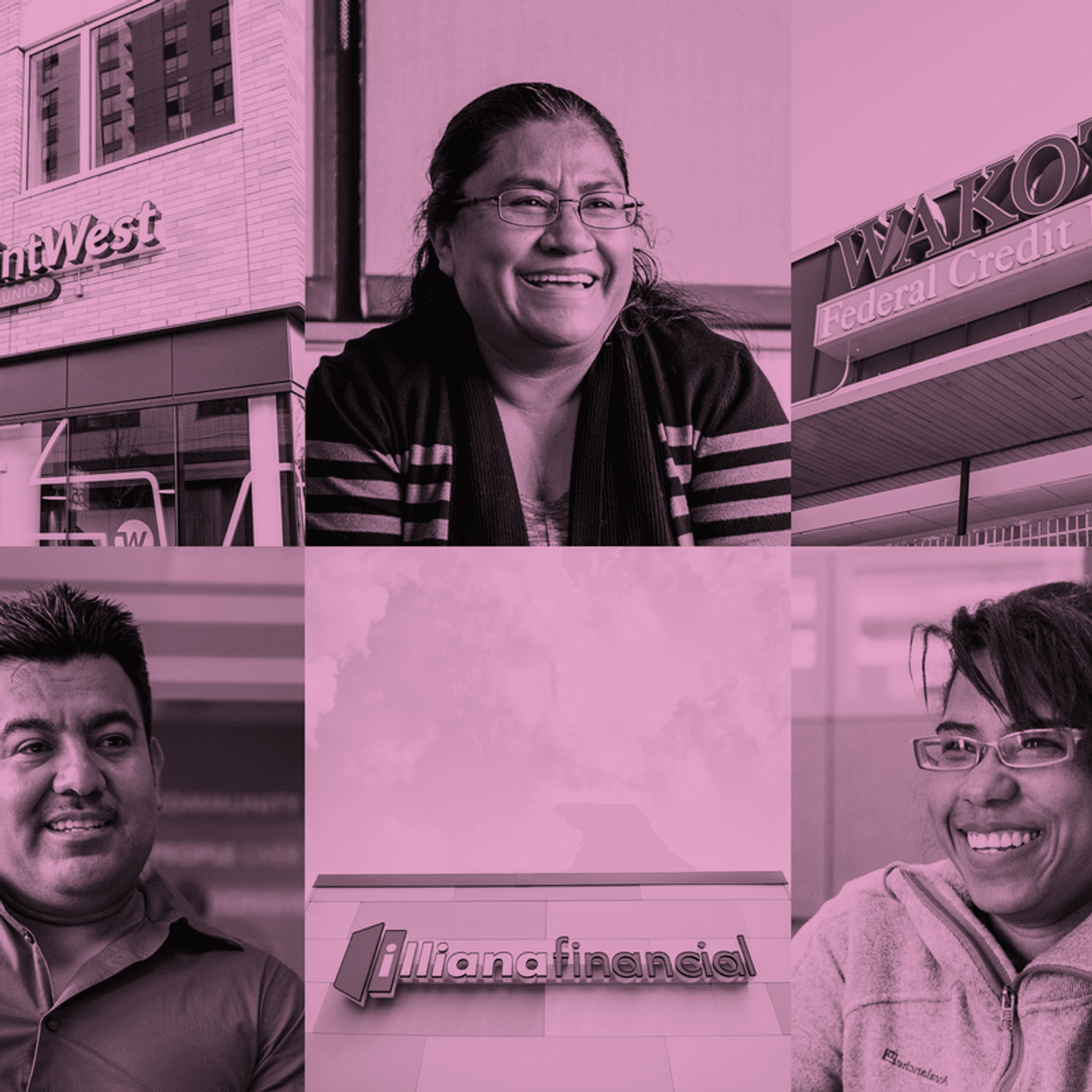

Our Partners

This ITIN online learning content would not be possible without the involvement and expertise of ViClarity.

Filene would also like to thank Visa for its financial support and ongoing leadership on financial inclusion that has made the Reaching Minority Households project and its series of reports and ITIN Lending resources possible.