Declining consumer savings since the pandemic

After the initial shock of the 2020 pandemic and recession, credit unions across the country saw a massive influx of savings from members. Consumers cut back on spending and took advantage of private-sector and government support—direct cash transfers and emergency payments, fee waivers and loan repayment pauses, PPP loans, and more—to start putting money away in record amounts. As a result, many measures of consumer financial health improved in 2020 and 2021.

Today, any gains in savings that consumers made during the pandemic appear to have almost entirely disappeared. According to the Financial Health Network, financial health in the U.S. declined in 2022 for the first time in the past five years.

Any gains in savings that consumers made during the pandemic appear to have almost entirely disappeared.

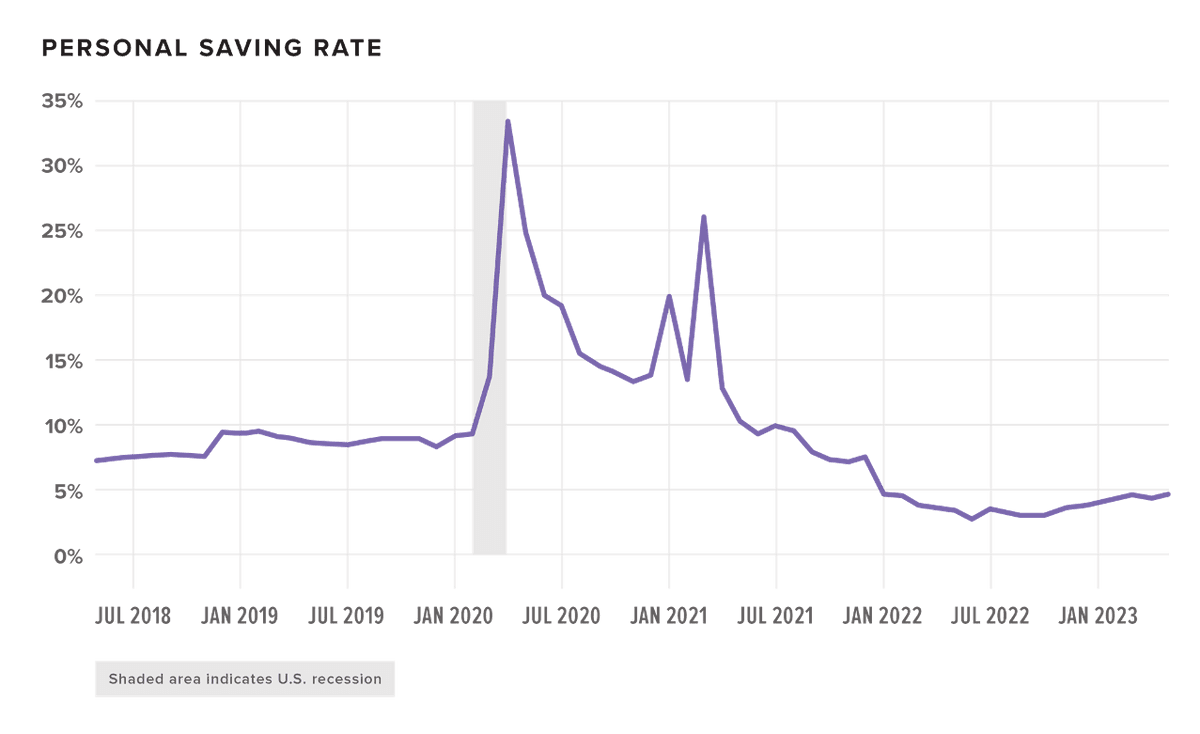

More recent economic data bear this out. The national personal savings rate has remained stubbornly below 5% since January 2023, despite pre-pandemic savings rates of between 7–9%.

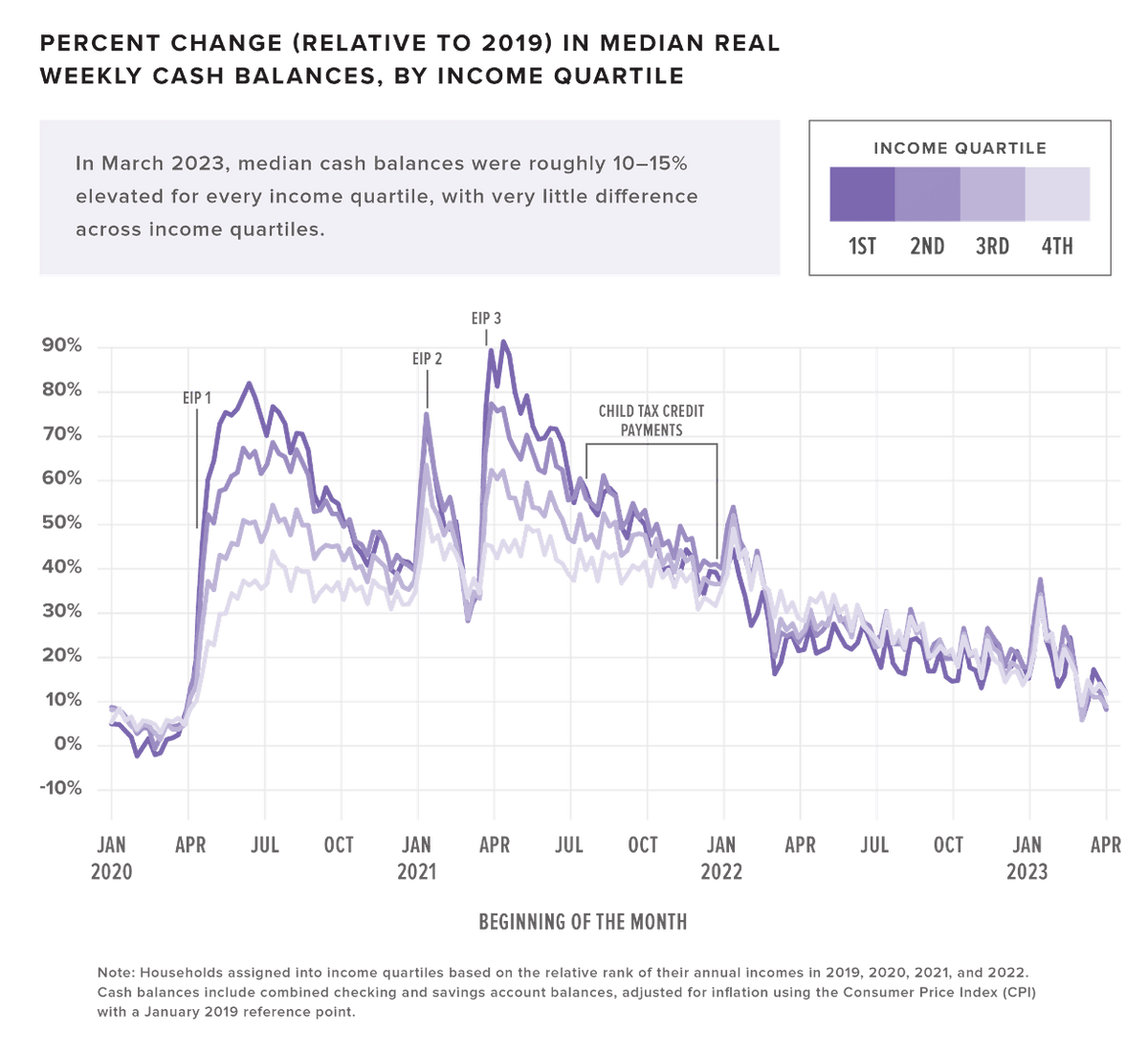

What’s more, the cash consumers set aside during the pandemic has now been spent. The JPMorgan Chase Institute found that the excess cash savings consumers had accumulated since March 2020—up more than 90% in the middle of 2021 relative to 2019—were almost completely gone as of March 2023, no matter consumers’ income level.

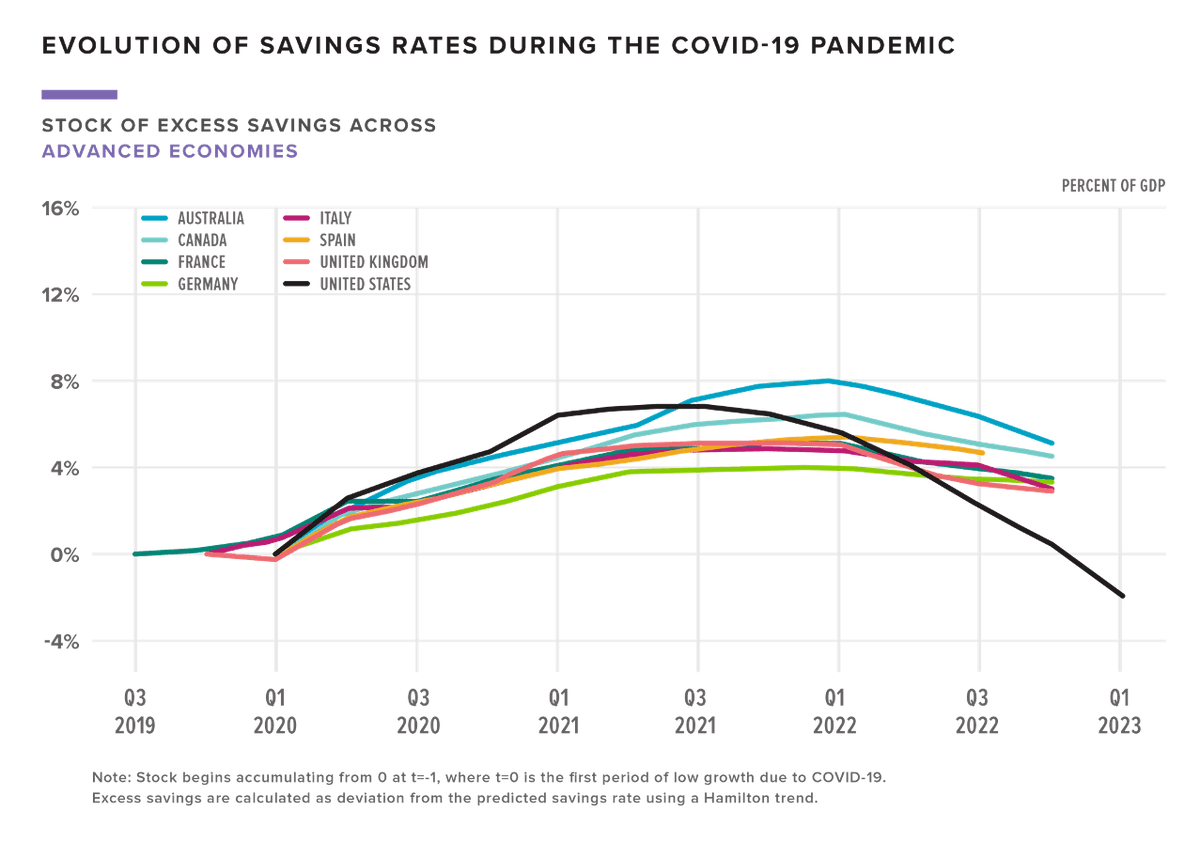

A new research note from the Federal Reserve shows much the same. Consumer savings in the U.S. (and many other countries as well) spiked with the outbreak of the pandemic. But after peaking in the third quarter of 2021, these savings were then rapidly drawn down. Fed researchers estimate that excess savings stock in the U.S. was “completely depleted” in Q1 of 2023.

The Fed’s Survey of Consumer Expectations June Credit Access Survey also shows decreased consumer savings. The SCE Credit Access Survey polls consumers every four months on subjects like credit demand, applications, and expectations. It also measures financial fragility by asking consumers about the likelihood that they will need or be able to come up with $2000 in the next month. In June, the difference between these two numbers dropped to the lowest level on record: More consumers believe they will need extra cash and fewer expect they will be able to secure it.

More consumers believe they will need extra cash and fewer expect they will be able to secure it.

What will be the impact of declining consumer savings on credit unions?

The upside to these data is that the ability to draw upon their savings has no doubt supported consumer spending and the U.S. economic recovery overall. The downside is that the financial challenges facing consumers may just be beginning. Without a cash buffer, household budgets may be stretched very thin.

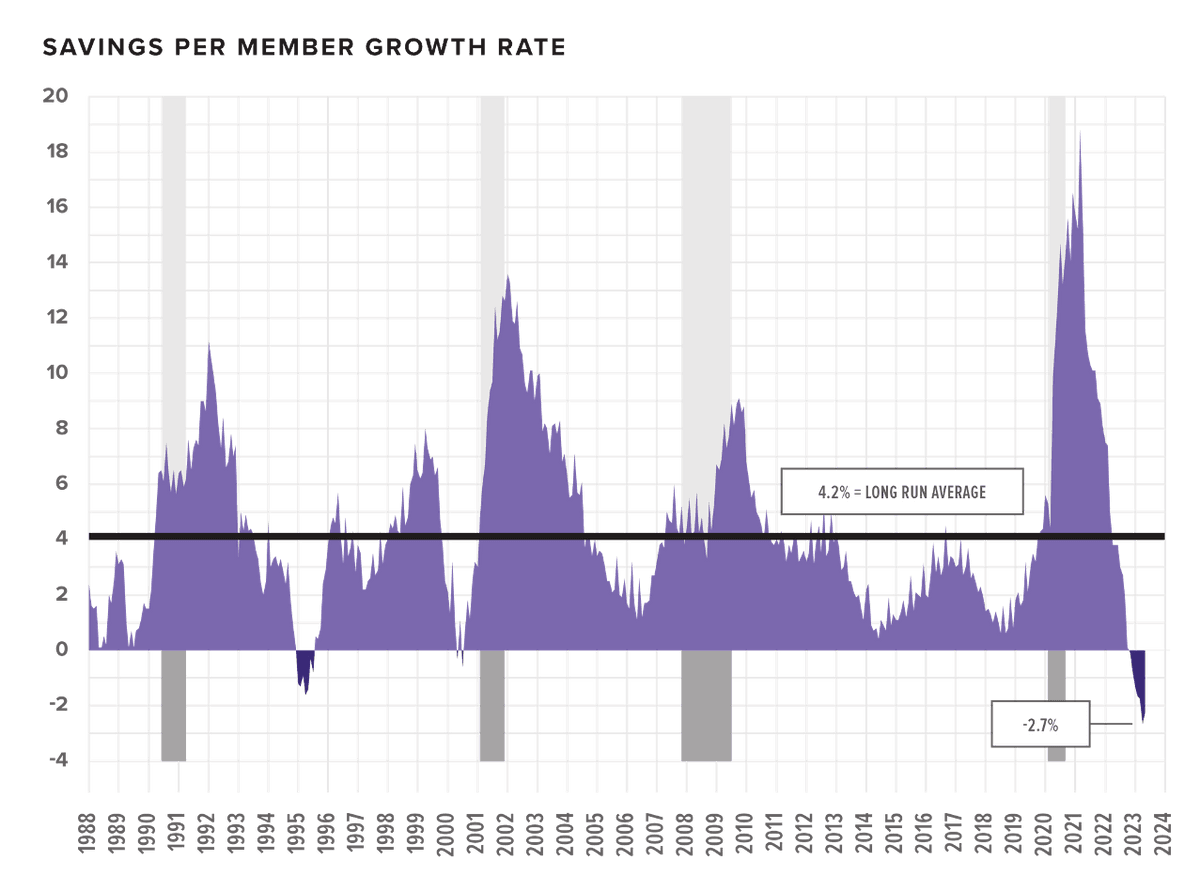

For credit unions, this means that the war for deposits may intensify even further as consumers simply have fewer dollars to save among the many competitors for their savings. Already 2023 is the first year that we have seen per member savings balances decline for the credit union industry overall since the 1990s.

Expect increased competition for consumer deposits, as well as potentially falling loan demand as consumers pull back in the face of other financial commitments.

So what can credit unions do?

The truth is, there is no easy solution to combat declining consumer savings. This is a challenging short-term macroeconomic environment for credit unions, one that will require very careful balance sheet oversight and asset-liability management by credit union leaders.

Credit unions are not, however, helpless.

- Lean into payments, which drive relationships between consumers and financial services providers and provide day-to-day cashflow, as well as non-interest income.

- Track member ACH connections to understand where their deposits are flowing and target them appropriately.

- Get creative in incentivizing savings, especially for younger members. Prize-linked savings is one proven approach, and brand-new research from Mexico shows the continued promise of using lotteries to attract deposits. There are other options too: using behavioral nudges like securing people’s commitment to save, automatic saving features, and rewards can all encourage enhanced engagement.

- Credit unions should also consider expanding or deepening their business services to attract deposits from small businesses and entrepreneurs—some of whom they may already be serving as retail members.

- Finally, understand that what’s at stake, ultimately, is consumer financial health and well-being. Good options for loan consolidation, small-dollar emergency credit, and financial coaching can be invaluable for some members as they face new or growing financial challenges.

Credit unions can win deposits on rates in some cases. At the same time, the environment is shifting rapidly, and leaders should be aware of changing consumer needs and expectations and take the long view with a focus on building relationships.

Want to connect and learn more about hot topics and trends like this that have an impact on credit unions? Be sure to subscribe to Filene's new LinkedIn Thought Leadership Newsletter - Thinking Forward!