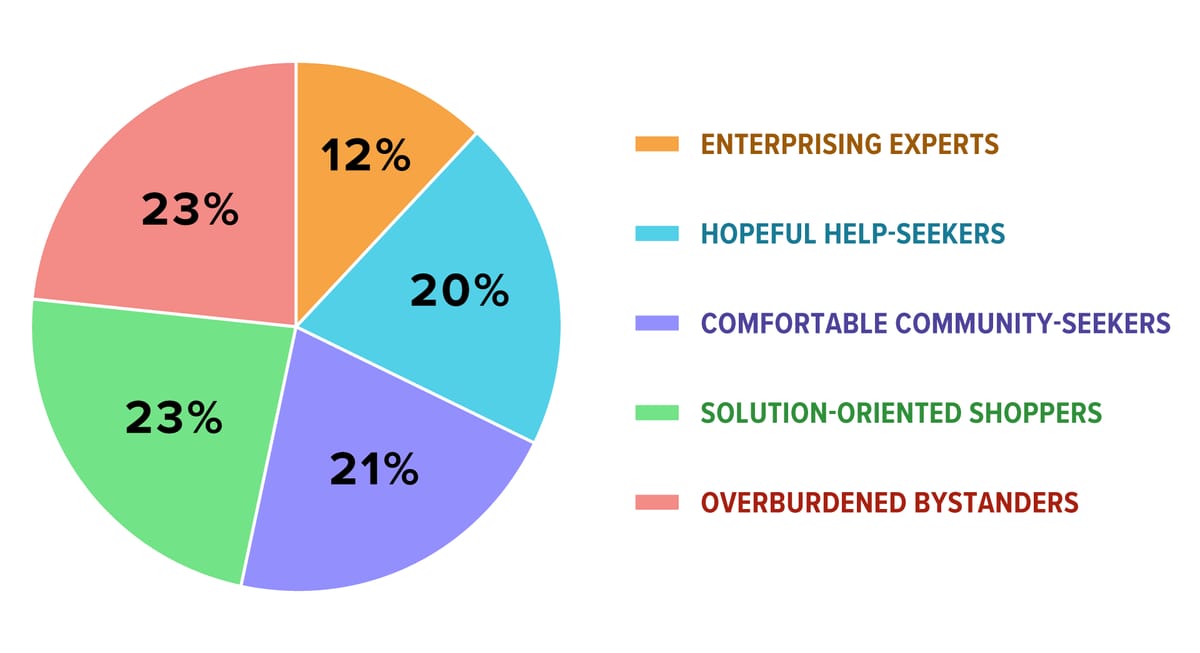

In the waning months of 2023, Filene conducted a large nationwide survey of nearly 5,000 credit union members, asking about their needs, attitudes and motivations. From that research, we developed our Member Voice segmentation program, identifying five types of credit union members:

Hopeful Help-Seekers (20% of members nationally)

- Struggle with their finances

- Seek education and guidance to improve their financial situation

- Looking for personal and supportive relationship with a financial institution

Comfortable Community-Seekers (21% of members nationally)

- Financially comfortable and confident

- Not necessarily looking for advice or education

- Value personal connection, in-person service, belonging

Solution-Oriented Shoppers (23% of members nationally)

- Feel financially secure

- Interested in expert support, innovative solutions

- Willing to shop around to find the best available products and services for their needs

Overburdened Bystanders (23% of members nationally)

- Struggling financially

- Not receptive to advice or education

- Don’t know what they’re looking for

- Ambivalent, unsure about their finances

Enterprising Experts (12% of members nationally)

- Highly confident and feel financially secure

- No interest in receiving advice or guidance

- Looking for advanced tools and best value

- Want to optimize their finances for themselves

We’ve discussed these segments in this space before, and there is more information on our website: https://www.filene.org/programs-services/advisory-services/member-voice

But in this post, I want to talk about how these different types of members interact with their credit unions (and other institutions). When do they prefer self-service channels and when do they prefer to interact with an employee? Which interactions need human intervention? Are there segments who are wholly self-service?

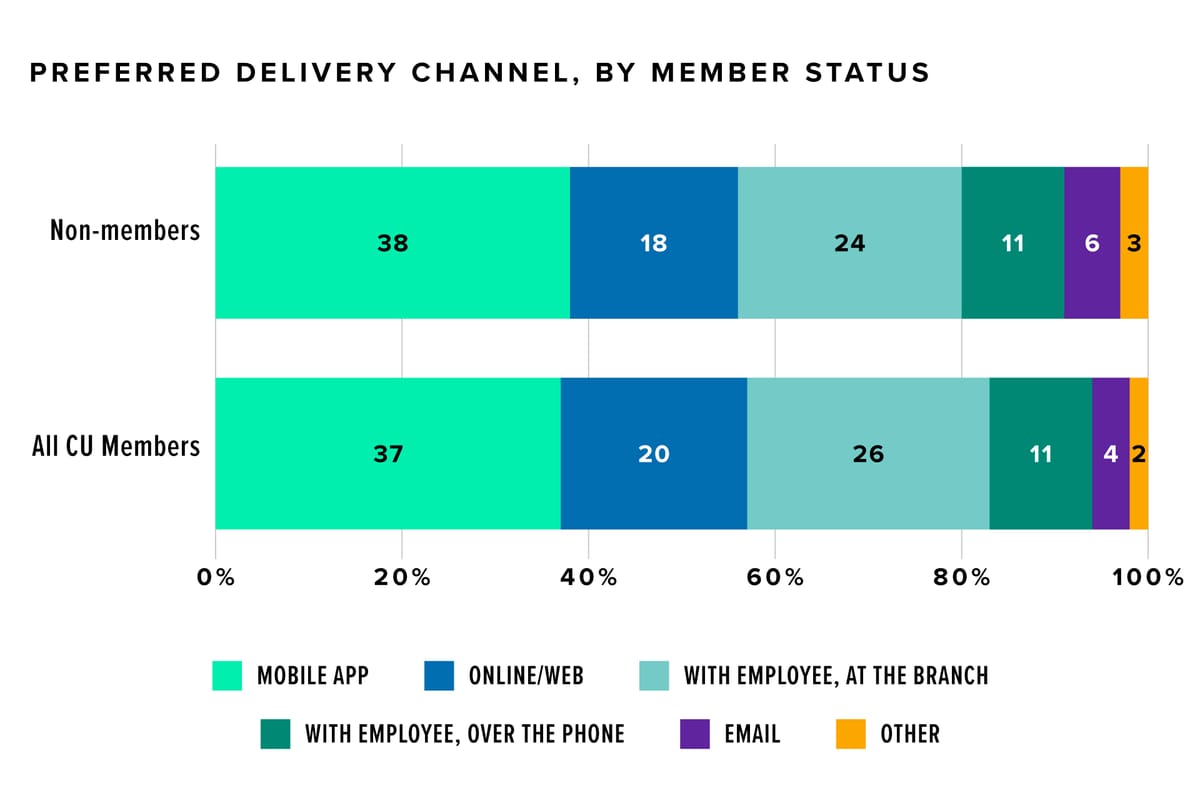

Preferred Channels

First, let’s look at preferred channel overall. In what might be a surprise to some, there is almost no difference between which channels credit union members and non-members prefer:

57% of credit union members said their preferred channel is self-service, either on a mobile app or a website, compared to 56% of non-members, meaning no statistical difference.

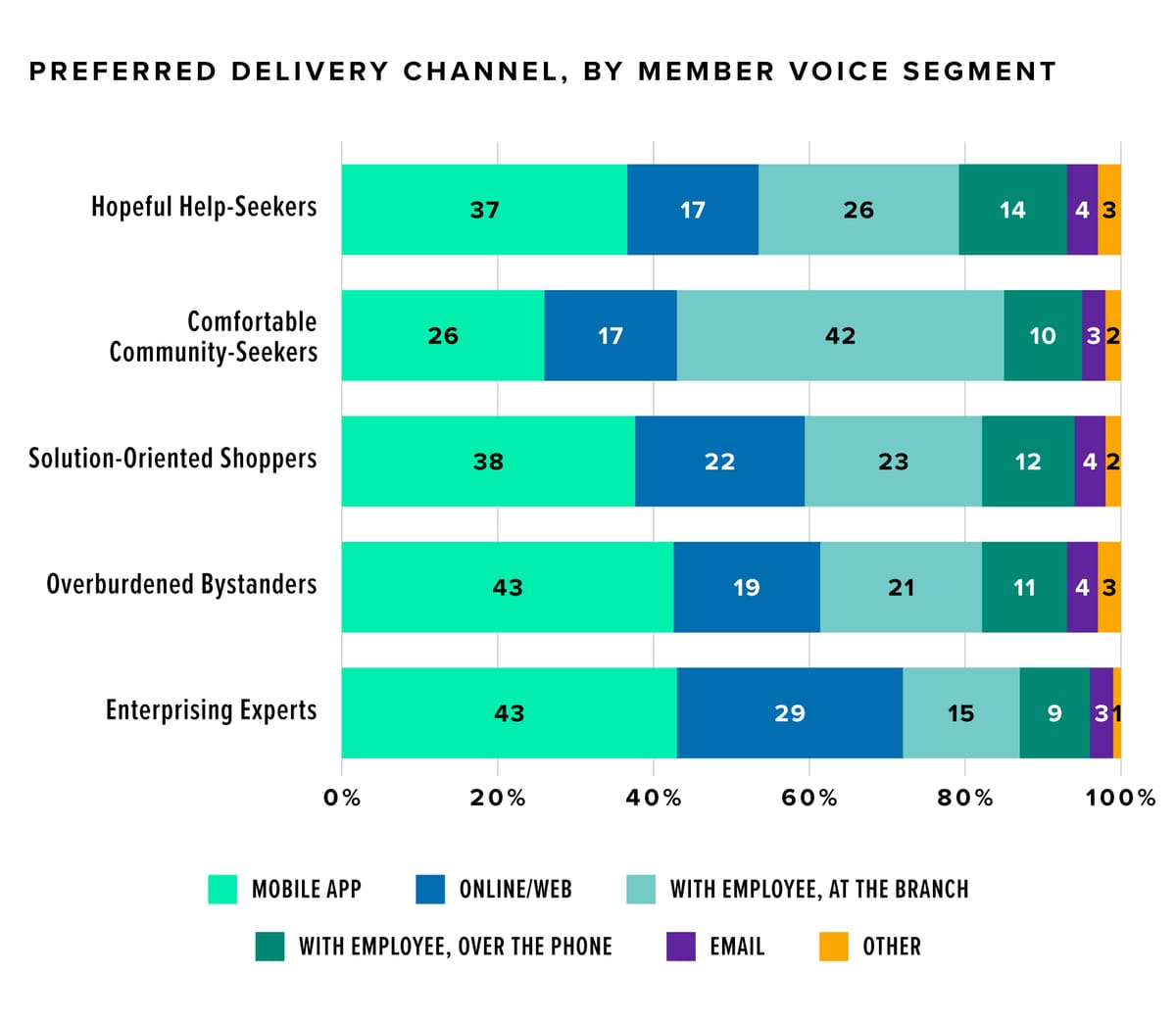

When we look at the five Member Voice Segments, only the Comfortable Community Seekers prefer employee-assisted delivery channels. On the other side of the scale, Enterprising Experts, a group we describe as independent and motivated to use the best tools, prefer self-service options.

Looking at this chart, it’s tempting to say, “We know most our members are Solution-Oriented Shoppers and Enterprising Experts; therefore, we can close our branches in favor of our mobile app,” but preferred channel only gets at part of the story. Each credit union member approaches each interaction differently!

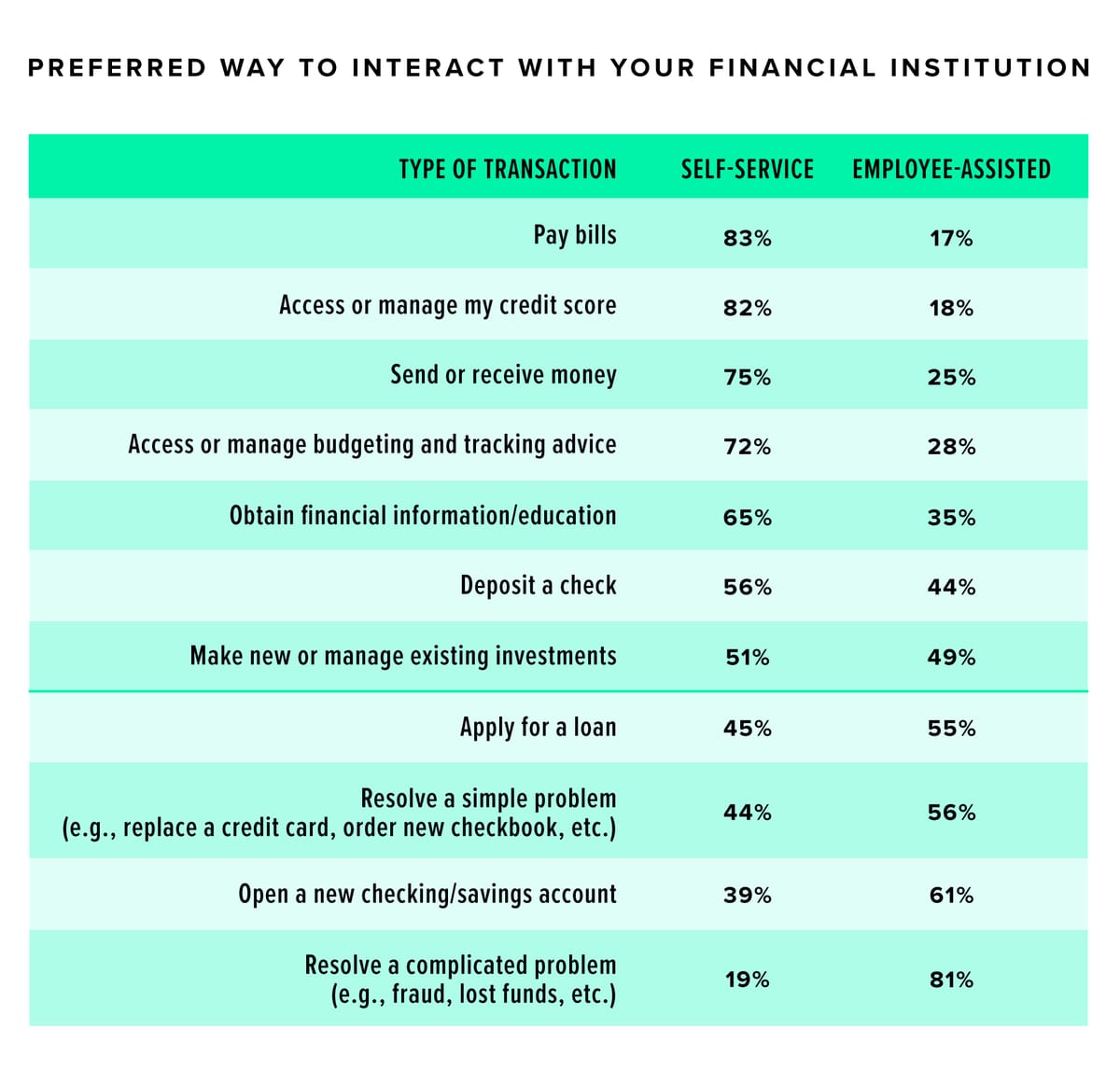

Transaction by Interaction Preferences

Here, we’ve sorted different transaction types by the percentage of credit union members who prefer to do that task via a self-service or employee-assisted channel.

As you can see, members prefer to use self-service channels for basic transactions like paying bills, accessing their credit score, and sending money, but when it comes to opening an account or resolving a problem, members prefer to speak to employees. Meanwhile, when it comes to managing their investments, member preferences are split on whether self-service or employee-assisted is preferred.

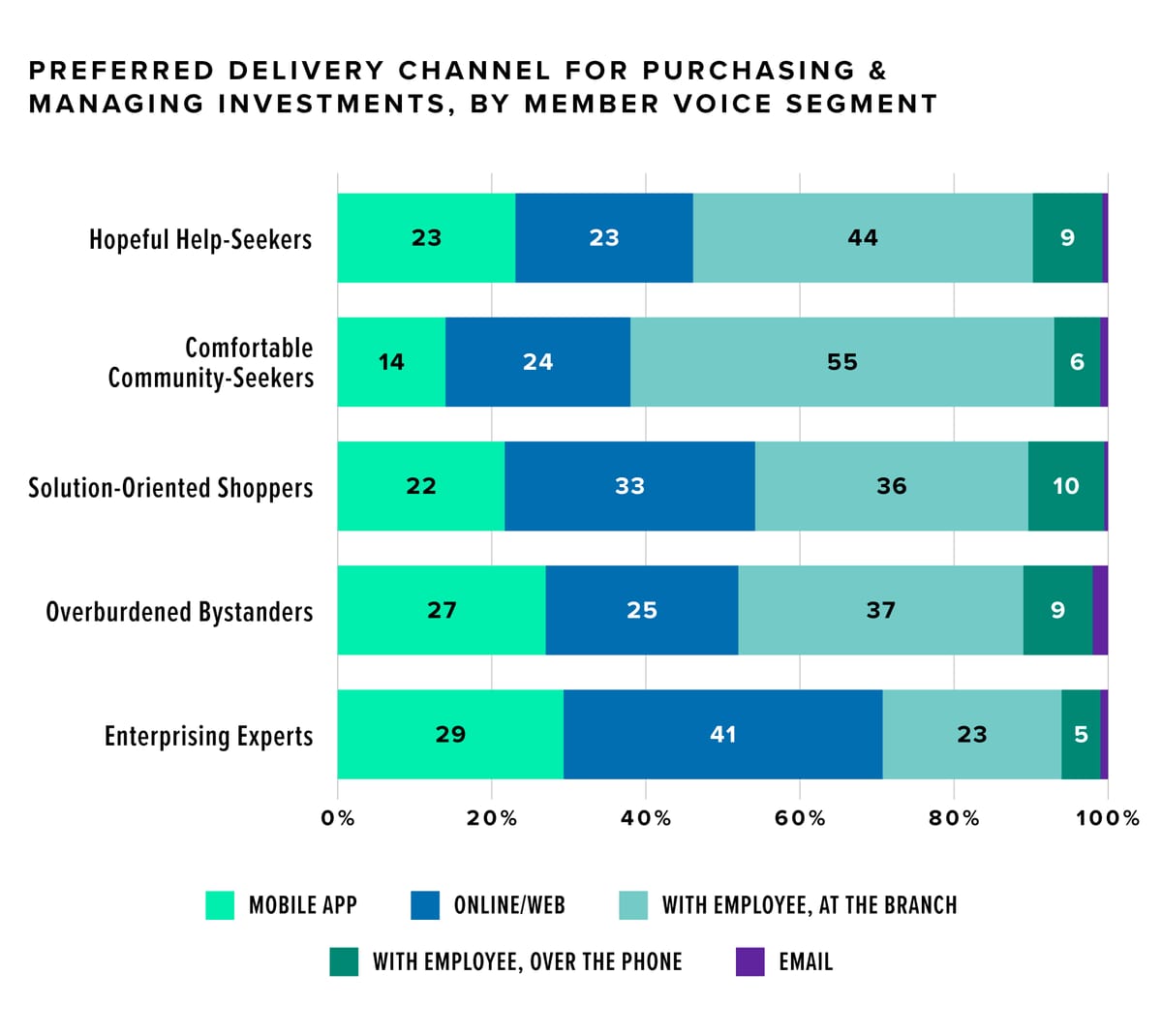

Making New or Managing Exploring Investments

When we look by Member Voice segment, we start to learn a lot more. As we noted above, members overall are evenly split between preferring to manage and purchase investments with employee assistance and without. However, if we focus on the three segments that are most likely to have investments, we see three different patterns.

Comfortable Community-Seekers, the bedrock of the old Wealth Management model, vastly prefer working with an employee, specifically in person. Meanwhile Enterprising Experts, the target of the investment fintechs, are completely comfortable managing their investments online. That leaves the Solution-Oriented Shopper: the group most likely to use a financial advisor. They slightly prefer self-service to employee-assisted.

Can both of those ideas be true? Yes! They appreciate expert advice and recommendations for their investments, but they also value the convenience of managing those investments online on their own schedule. Offering that expertise and convenience could be a great way for credit unions to build their investment business with this key segment.

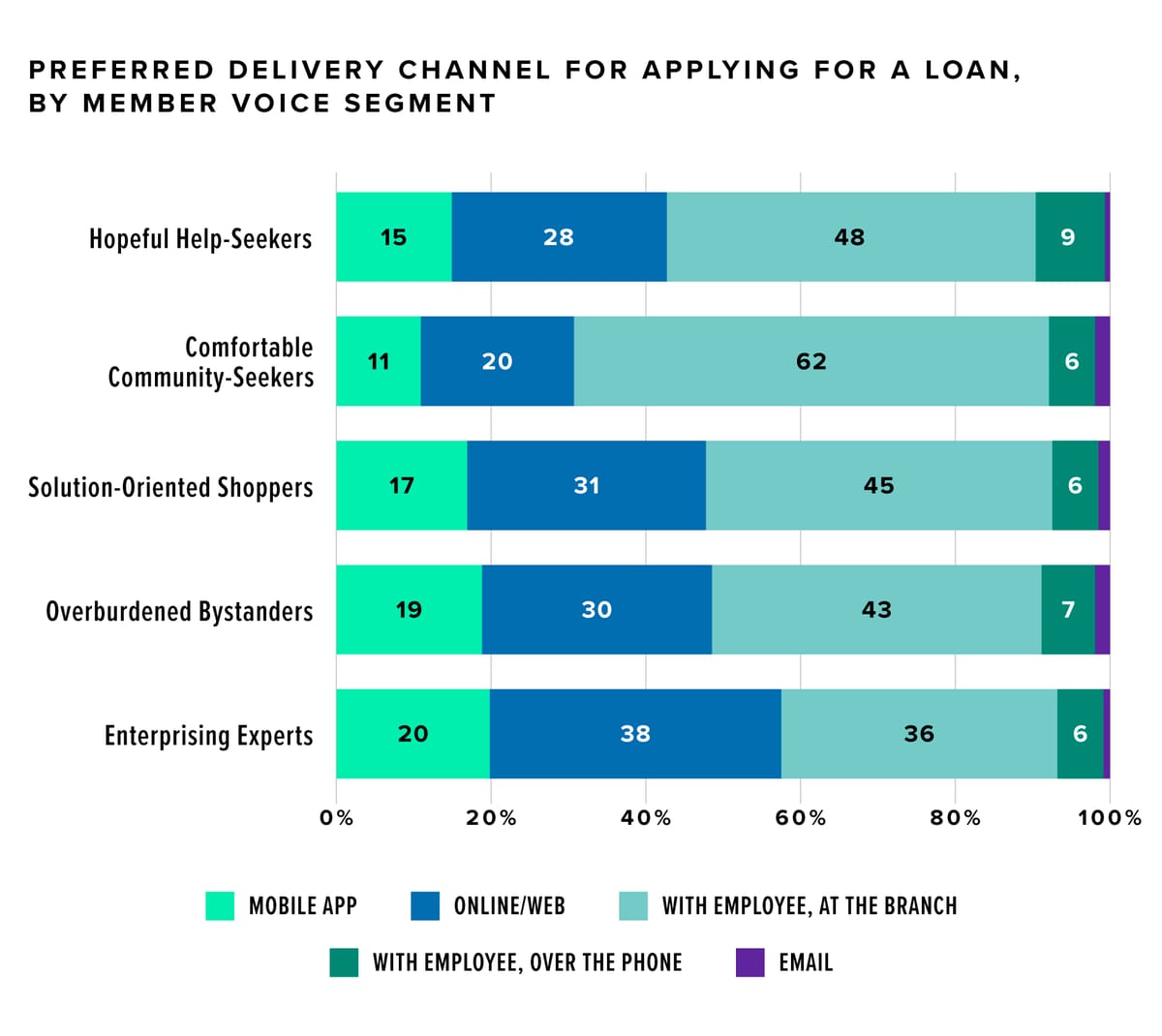

Applying for a Loan

Let’s dig into a much more important activity for most credit unions: lending. Perhaps surprisingly to many of us, the typical credit union member still prefers to apply for a loan with the assistance of an employee, typically at a branch.

At one end of the spectrum are the Comfortable Community-Seekers, who as with investments, vastly prefer working with an employee to apply for a loan. At the other end, we again have the Enterprising Experts who generally prefer to borrow without help, typically from their PC. The other three segments all slightly prefer borrowing with an employee’s help, including notably the Hopeful Help-Seekers

Our key takeaway here is that while robust and easy mobile and online borrowing capabilities are valuable, credit unions cannot overlook the value of having lending experts in the branches. Being present to discuss options and being capable of explaining the value of your credit union’s loan offerings can make a significant difference in capturing that business from your members.

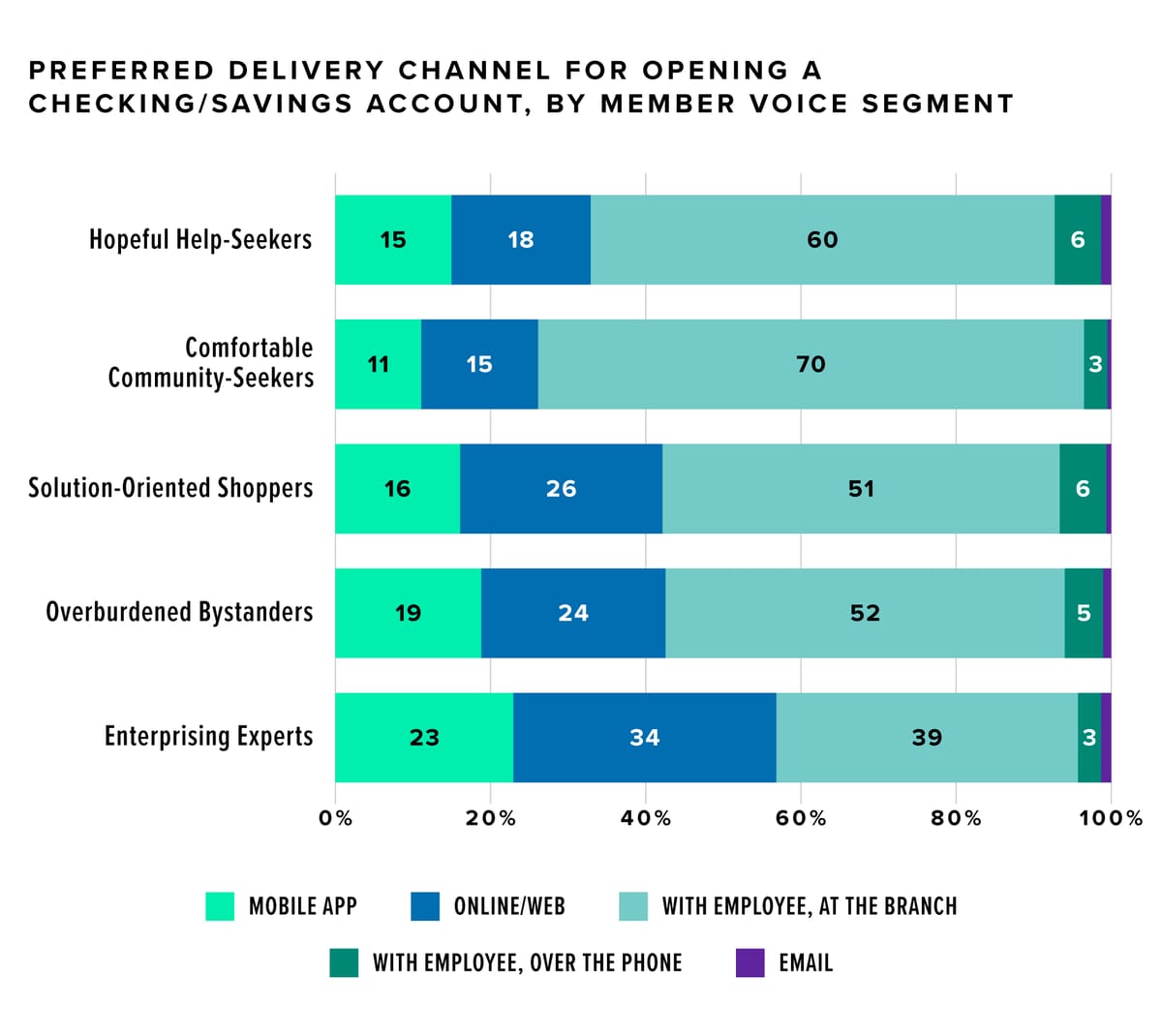

Opening a New Checking/Savings Account

Lending can be complicated, with all the regulatory paperwork. Surely most members will be happier opening a deposit account online, right?

The differences here are even more stark. Yes, the Enterprising Experts prefer to open checking and savings accounts online, but they are the only segment that does, and they only represent 12% of the credit union membership nationally. The other 88% of credit union members are far more likely to prefer to open these accounts in a branch.

Branches still have value as deposit gathering locations. While having the ability to open and fund accounts online will remain important, having an easy process to discuss savings products and options in person continues to be more important.

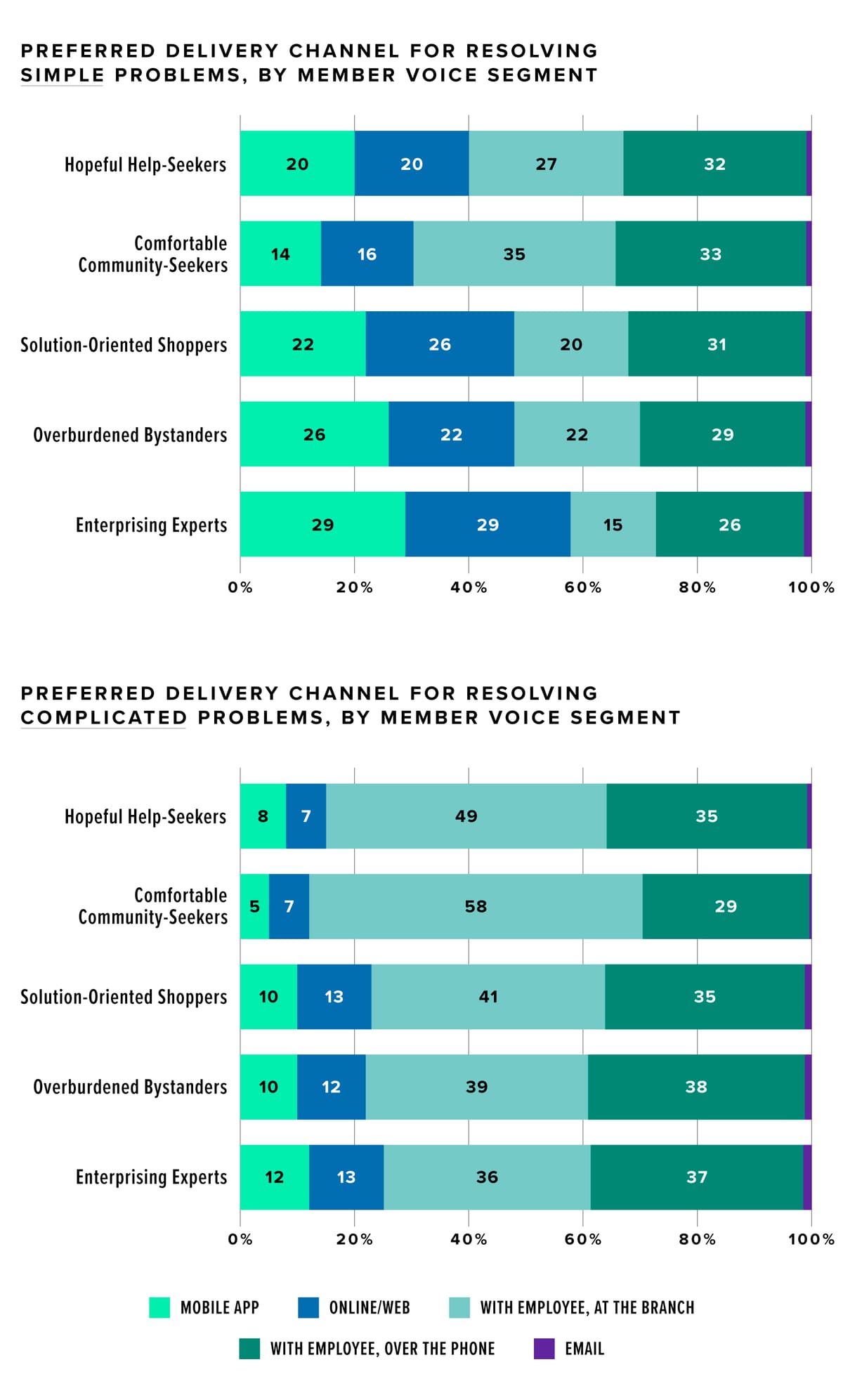

Resolving Problems

Finally, let’s look at problem resolution. For this we asked members to differentiate between resolving a simple problem (e.g., replace a credit card, order new checkbook, etc.) and resolving a complicated problem (e.g., fraud, lost funds, etc.).

For simple problems, the Enterprising Experts once again prefer to seek resolution on their mobile phone or online, while the other four segments prefer speaking to an employee, particularly over the phone.

For complicated problems, even the Enterprising Experts prefer to deal with actual employees, with only 25% seeking to resolve the issue themselves.

Here is where we see the value of a contact center. In every case, 26%-38% of members prefer to solve problems with a phone call, especially if the issue is a complicated one. A contact center should be focused not on basic tasks, like transferring funds or taking payments, but on solving member problems.

Conclusion

The challenge of delivery is that each new channel is additive. They do not replace pre-existing channels; they add to them. Most credit union members have happily moved to self-service channels for basic transactions, but for complicated activities like opening accounts and resolving problems, most members still prefer to work with an employee. Branches and call centers still have immense value to members and for credit unions. How much value really depends on the credit union’s mix of member voice segments. Understand how your members feel about using your credit union will help you create a delivery strategy for the decade ahead.

— CV