Credit unions and fintechs both have compelling reasons to create mutually productive partnerships. Credit unions want to leverage fintechs to improve member experience, increase operational efficiencies, attract new members, and compete with banks. At the same time, fintechs can benefit from partnering with an organization with an aligned mission, due to their access to an established member base allowing for easier testing and piloting..

However, partnerships often face challenges in planning, communication, and implementation, which can lead to extended timelines, increased costs, and sometimes, abandoned projects.

One of our goals this year at FiLab has been to strengthen partnerships between credit unions and fintechs. We've been asking, 'What can credit unions do to foster successful and impactful collaborations with fintechs?'

Filene Research Institute

Becoming a Better Buyer

This year, we’ve identified steps credit unions can take to create stronger partnerships with fintechs.

The key takeaway for credit unions is to understand what you want to do, understand what tech tools you have at your disposal, and then coalesce around potential fintech partners that meet those needs and possess those capabilities.

For credit unions, this involves not just evaluating fintech solutions based on surface-level features or costs but taking a comprehensive and deliberate approach to ensure long-term success and alignment with organizational goals.

“Credit unions come to the conversation [with fintechs] ready to learn, but they’re not adequately prepared,” said Leighton. “Credit unions need to become better at setting expectations. They need to become better buyers.”

What does it mean to become a better buyer?

First, it requires going beyond what is already known internally about strategy and technology, so your organization can uncover critical details that could make or break the partnership.

To do so, the right people need to be at the table to make a complete and systematic evaluation.

A Three-Step Evaluation

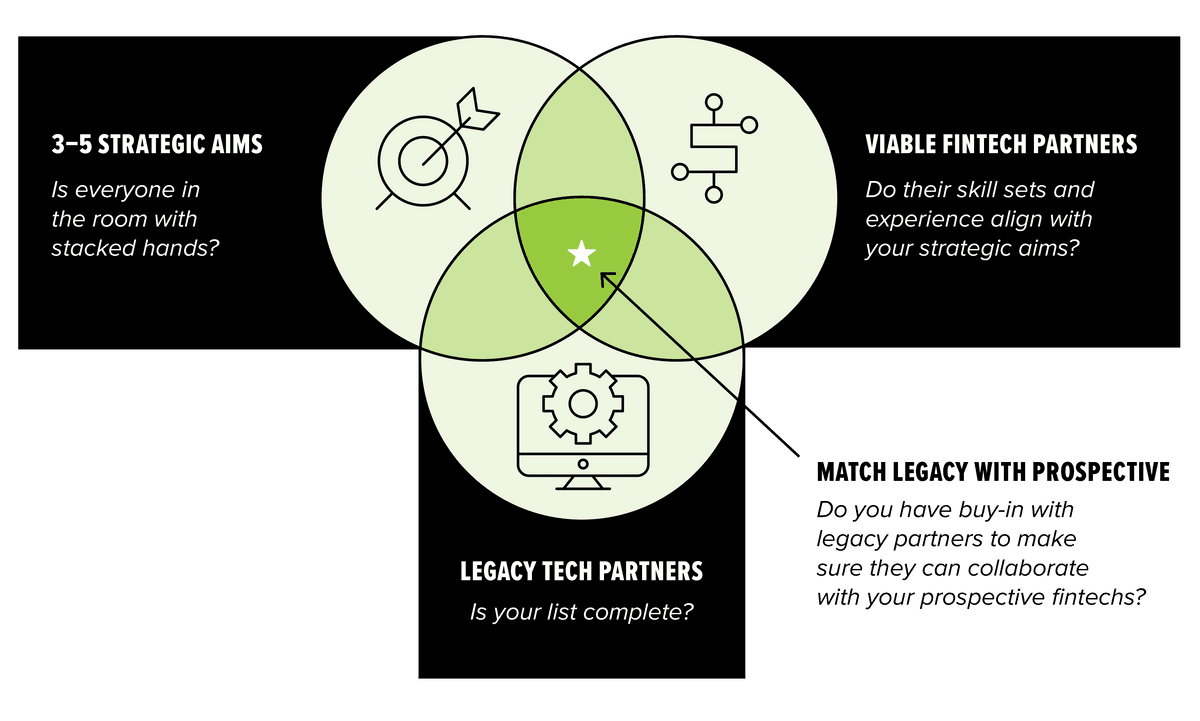

To help credit unions make a systematic evaluation and uncover those critical details, FiLab has developed a three-step method and Venn diagram which can help guide the process.

1: Identify 3-5 strategic goals

Your organization can only do so much at one time. Identify 3-5 strategic goals you’re going to accomplish with the fintech partnerships.

And be sure you have everyone in the room who can help identify these goals. That may mean everyone from the CEO to member-facing employees. The aim is to gain internal alignment on top-priority strategies.

Some examples of strategic goals are:

- Member Experience: Ensure the fintech partner aligns with the credit union's member-first philosophy and provides a seamless and intuitive user experience.

- Scalability Needs: Assess if the fintech partner can scale with the credit union's growth and adapt to future needs.

- Technology Improvements: Explore how the fintech partner can help phase out outdated systems, strengthen cybersecurity, or integrate AI or blockchain services.

2: Account for your legacy tech partners

If your organization is going to partner with a fintech, it’s essential to map out a 360-degree view of legacy tech partners.

These partners are going to play a critical role in your projects, especially with integration and implementation. Make a complete list of your partners for core services, payments, payment network, loan origination system, data warehousing, etc. Then, evaluate how these systems integrate with fintechs, what a timeline would look like, and how it could impact the total cost of the pilot.

3: Viable fintech partners

Step three involves researching the fintechs who can meet your specific goals. What fintechs can work with legacy tech partners and demonstrate proven experience in offering the services appropriate to your goals?

For instance, are your aims to improve underwriting capabilities? If so, can your prospective partners support that need? Maybe they offer support in underwriting capabilities and account opening systems. Which do they do better?

Advice from our credit union testers

“Be explicit about third-party contracts and costs. Make sure your fintech partners understand the contractual relationships between the credit union, themselves, and any third-party partners the fintech may bring into the project.”

“Normally when we have a third-party partner, they are under the umbrella of our actual [fintech] partner, and if anything was to happen [with the third-party], then that partner would need to address it. But [our fintech partner] didn't really understand that contract.”

“A lot of times when we talk to fintechs, it's just them presenting their costs to implement or their cost to use the platform, but they don’t include any third-party costs that may be needed in addition to theirs. They need to be explicit about these intangible aspects of the partnership and what that organization's costs and contracting structure are.”

The Venn Diagram: Match legacy partners with prospects

The details generated by these three steps can be used to create a Venn diagram and help credit unions ensure internal alignment and avoid partner misalignment.

“It’s important that credit unions put together a Venn diagram in advance of having conversations with any fintechs,” said Leighton, “and more importantly, to use it for identifying fintechs they can work with.”

These three steps represent one circle each. Where the three circles overlap in the center is where potential fintech partners are revealed. These potential partners can meet your goals and work with your legacy tech partners.

Note: Be sure to communicate and get buy-in with legacy partners to make sure they can collaborate with your prospective fintechs. Then you can narrow the list of prospects and engage in substantive dialogue that push the project forward.

A Venn Diagram Template

We’ve created a template to help credit unions start the process right. Go through each circle and category, list the details and your questions. Be exhaustive.

Case study examples: Top issues we have seen this year

“FiLab has worked with many credit unions and learned of their successes and challenges,” said Freshour. “From our experience we can share a few top-level lessons that can help credit unions avoid common mistakes.”

Timing versus goals

Consider the fintech's perspective. Because they may specialize in solutions for specific issues, while operating at a smaller scale, fintechs may work on a different timeline than credit unions.

If timelines are not clearly discussed, credit unions can underestimate the time required for pre-implementation discovery, causing unanticipated delays. Additionally, many fintechs have overestimated the timing of implementation, often anticipating a much faster process than is feasible.

Advice from our credit union testers

“In almost every fintech presentation, the fintech says they can get you up and running in 24 hours. I tell people it's not true. It’s never 24 hours. You're creating an expectation that can't be met. It creates conflict because senior leaders who aren't in the project believe it, but the people actually doing the work have to say that timeline is not going to happen. It’s important to control the narrative, because it'll be a lot less painful in the end.”

“In my opinion, any new fintech automatically gives the project three additional months. And that is just for discovery, to be able to go in, understand what is required, turn over all of those stones, understand what partners are needed.”

“I think for any fintech project, added time needs to be included in the implementation because many fintechs are not robust in their technical specifications. They are uncovering new use cases based on the credit unit they're trying to implement with. There is going to be a learning curve on both sides.”

Digital banking dependencies

Existing digital banking infrastructure can have contingencies that hinder certain fintech integrations. Be sure to raise the issue with legacy and prospective partners to assess dependencies upfront and help mitigate downtime and ensure smoother implementation.

Data sharing and AI-related challenges

Data sharing, especially for AI-driven initiatives, can face obstacles with regulatory concerns and internal policies. Because AI data sharing policies are still developing, challenges around data sharing can hinder projects. For faster onboarding, credit unions with API capabilities experienced smoother integration, while others faced limitations due to vendor constraints or evolving data-sharing policies.

Stack awareness

Knowing your tech stack is essential because implementations become increasingly complex with each added third-party partner. Data needs can often be identified too late, leading to bottlenecks and delays.

Advice from our credit union testers

“One thing we do is to request data dictionaries very early on in the process, and to make sure that our data engineering team has a really good understanding of what's included in the data dictionary. So that if there are any questions around fields that could be ambiguous, we have that information conversations sooner rather than later.”

“While we could easily say that every [credit union] should have a really robust and well-organized data warehouse, the reality is that very few do. It's probably fair to say that every credit union should be expecting that the data that they have on hand, as robust and as well organized as they think it is, probably isn't exactly ready to go. And so there should be contingencies and time built into implementation schedules to expect what is unexpected, but also very likely.”

As FiLab concludes its second year of testing, we recognize that fintech partnerships not only offer tremendous potential for credit unions, but they are often necessary.

Credit unions rely on fintech partnerships to design and implement new tech-based services, enhance member experiences and drive innovation and growth.

We will continue to report on how credit unions can leverage fintech collaborations so they can deliver greater value to their members, and stay competitive in an ever-evolving financial landscape. Stay tuned for more insights from FiLab!