When I was asked to write something about ChatGPT in relation to credit unions, naturally, I created an account with OpenAI, the company that developed this so-called generative AI tool, and entered the query: “Write me a 700 word essay on the use of ChatGPT for credit unions.” The results, which are reproduced on the right, were pretty uncanny, and pretty darn good.

ChatGPT, write me an essay

At the same time there were a few “tells” that got me wondering about the algorithms driving the system, and how the nature of my query (“write me an essay…”) led the system down a particular path. So I entered another query of the same form: “Write me a 500 word essay on alternative currencies in the style of Bill Maurer.” (Although the system generates a reply pretty instantaneously, I was too impatient for a lengthier response this time). Again, those tells. First, the identification of the subject or target with a clause separated by a comma explaining what or who that subject or target is (“credit unions, as non-profit financial institutions,…” “As a scholar in the field of anthropology and economics, I…”). Second, the classic essay format, with a thesis statement in an opening paragraph, a list of key benefits (six, in the credit union case), a “despite these” or “however” transition paragraph to a list of potential downsides or harms (three, as you’ll see below), and then a “we can overcome” paragraph before a rosy conclusion, opening with, of course, “In conclusion…”.

ChatGPT mostly relates perfectly plausible content, but, again, replicating a very unimaginative form. Which perhaps is just fine for an AI. But what about for credit unions?

Just like Bart Simpson in that classic episode of The Simpsons, caught unprepared in class one day for an oral presentation on a foreign country, ChatGPT follows cookie-cutter conventions to produce good, but not stunning, results. Think of ChatGPT as a "blurry" JPEG of the web, which means it will get the general gist of a query right, but important details could well be wrong. Sometimes the algorithm simply makes things up entirely. Bart made up the content for his presentation, but the hilarity in that scene came from his near-perfect replication of the form. ChatGPT mostly relates perfectly plausible content, but, again, replicating a very unimaginative form. Which perhaps is just fine for an AI. But what about for credit unions?

The tech oracles are receiving messages from the future about ChatGPT with an intensity we have not seen since, oh, I don’t know, the Segway was introduced. ChatGPT will: make Google obsolete, make writers obsolete, utterly transform education, displace programmers, replace workers, supercharge workers. For financial services, it will finally automate everything in the back office, make intranet data usable and valuable, provide financial advice, automate the onboarding of new employees (if there are any left!) as well as new members, and so on. And I do not doubt that some financial institutions will find ways of using it or similar tech to do such things.

But what about credit unions?

The formulaic responses of ChatGPT should make us pause. Tools like ChatGPT are perfectly suited to formulaic processes in a mediocre to OK sort of way (only the 52nd percentile on the SAT?). Like banks, credit unions have plenty of those processes, which can likely be assisted by a tool like ChatGPT. But that’s not where credit unions’ value proposition to their members resides. My bet is that services like ChatGPT will better serve big banks with anonymous (and dehumanized and dehumanizing!) customer service than high-touch credit unions that know and care deeply about their members.

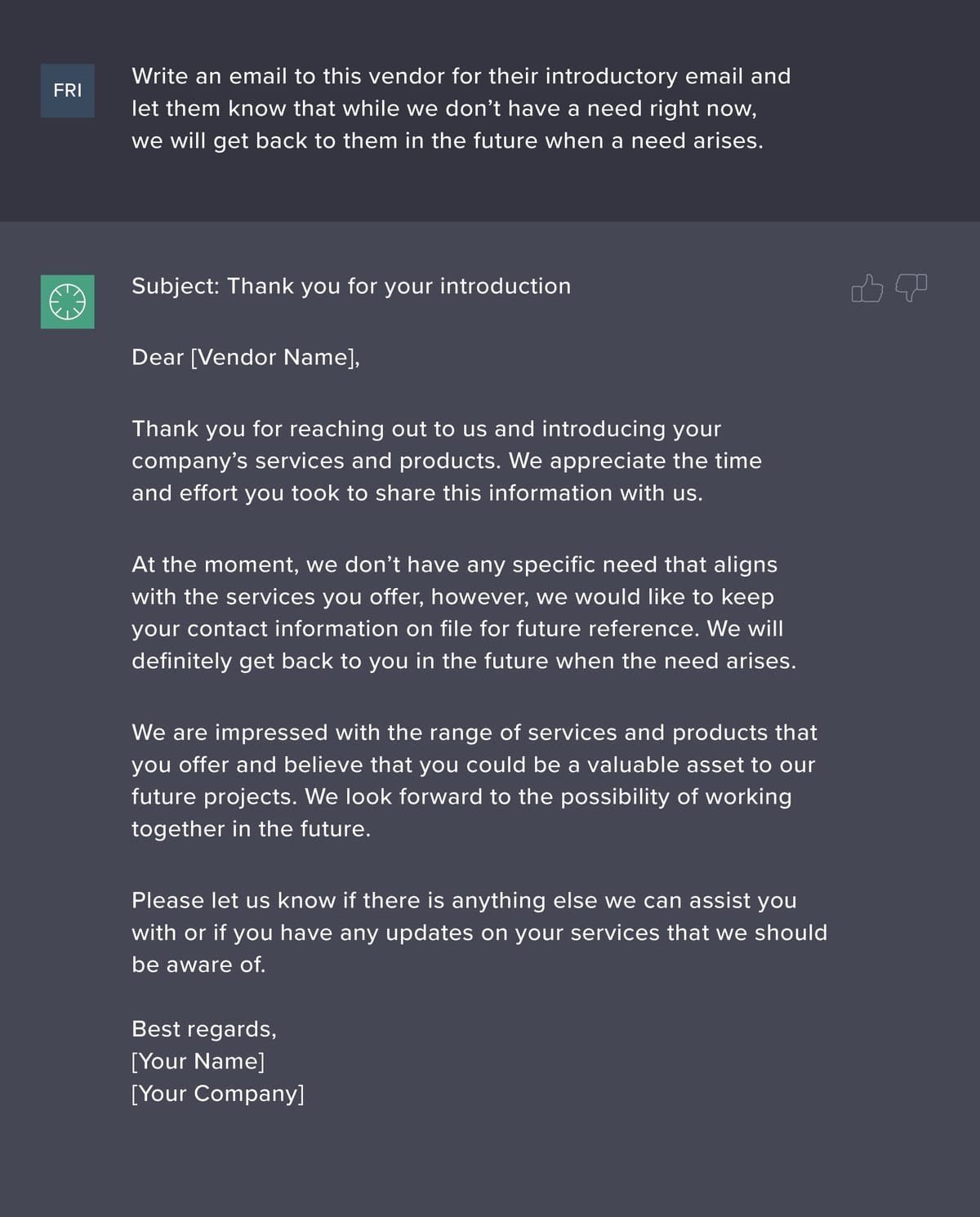

In a widely circulated LinkedIn post, Chris Nichols at SouthState Bank includes an example of an email to a prospective vendor generated by ChatGPT:

The Credit Union Contrast

For a bank’s relationship with a third-party vendor, that might be fine. For a credit union with its own network of partners, not to mention its members, this won’t cut it, not if the credit union wants to maintain if not deepen the kind of relationships that foster trust and the confidence that the credit union truly knows its partners and its members.

At one level, ChatGPT is way more sophisticated than my favorite chatbot, MSFCU’s Fran. But I bet Fran “knows” a whole lot more about MSFCU’s members than ChatGPT ever will. This is because one-size-fits-all rarely works in the credit union world, where each credit union serves a distinct field of membership linked by a common bond—even if, increasingly for some credit unions, it’s become harder and harder to tell the difference with a big bank. That should only make us try harder, though, and really promote—and really demonstrate—credit unions’ unique model and value.

ChatGPT provides an opportunity once again for credit unions to remember their key differences from banks, and to act on those differences.

ChatGPT provides an opportunity once again for credit unions to remember their key differences from banks, and to act on those differences. As ChatGPT reminds us, credit unions are nonprofit financial institutions, cooperatives, in fact (which ChatGPT seems not to have noticed), with members, not customers (which ChatGPT only realized at the very end of its essay). They have a “people helping people” mission. To quote Bart Simpson, credit unions provide “a land of contrasts” from banks—or, at least, they should.

Utilizing ChatGPT

In conclusion: ask yourself, what are you hoping to do with a tool like ChatGPT? Find efficiencies in routine processes? Play around with it, and see what it can do? Know your members? Maybe it will provide better data insights than your current systems? But be careful—it might not. It might return results at a general level of abstraction that will seem perfectly plausible but ultimately useless—unless you’re interested in treating your members like a big bank. Build trust? I doubt it. Unless you demonstrate that your use of such a service is meaningfully different from what a bank or fintech will do, and in doing so, you show your members that you’re not just jumping into the latest hype cycle, and instead always putting their interests first.