With the 2022 Earth Day theme being “invest in our planet” it is fitting to have the conversation amongst credit unions, the mission-driven arm of the financial services sector, around how our organizations fit into the broader climate discussion. We’ve seen time and time again how credit unions become first financial responders when climate-related events impact their communities. We’ve also seen those credit unions that are the most responsive during or after climate-related events grow, raise their brand awareness and increase their member loyalty. Credit unions are already investing in their people, their business, their members and their communities. It makes sense to also invest in our planet.

The Changing Climate for Credit Unions, produced jointly by Filene and Ceres Accelerator for Sustainable Capital Markets, is providing first-of-its-kind insights on how credit unions can respond to the climate crisis, mitigate their risks, and become part of a system-wide solution. The report, scheduled to be released next month, will highlight ways that credit unions can (1) look inward, toward their own products, practices, and investments to mitigate climate risks; (2) look outward, to help the communities they serve, such as low-income communities, to build resilience; and (3) come together as an industry to formulate shared visions, values, and practices for greater collective impact.

An excerpt from Filene Fellow Dr. Mai Thi Nguyen:

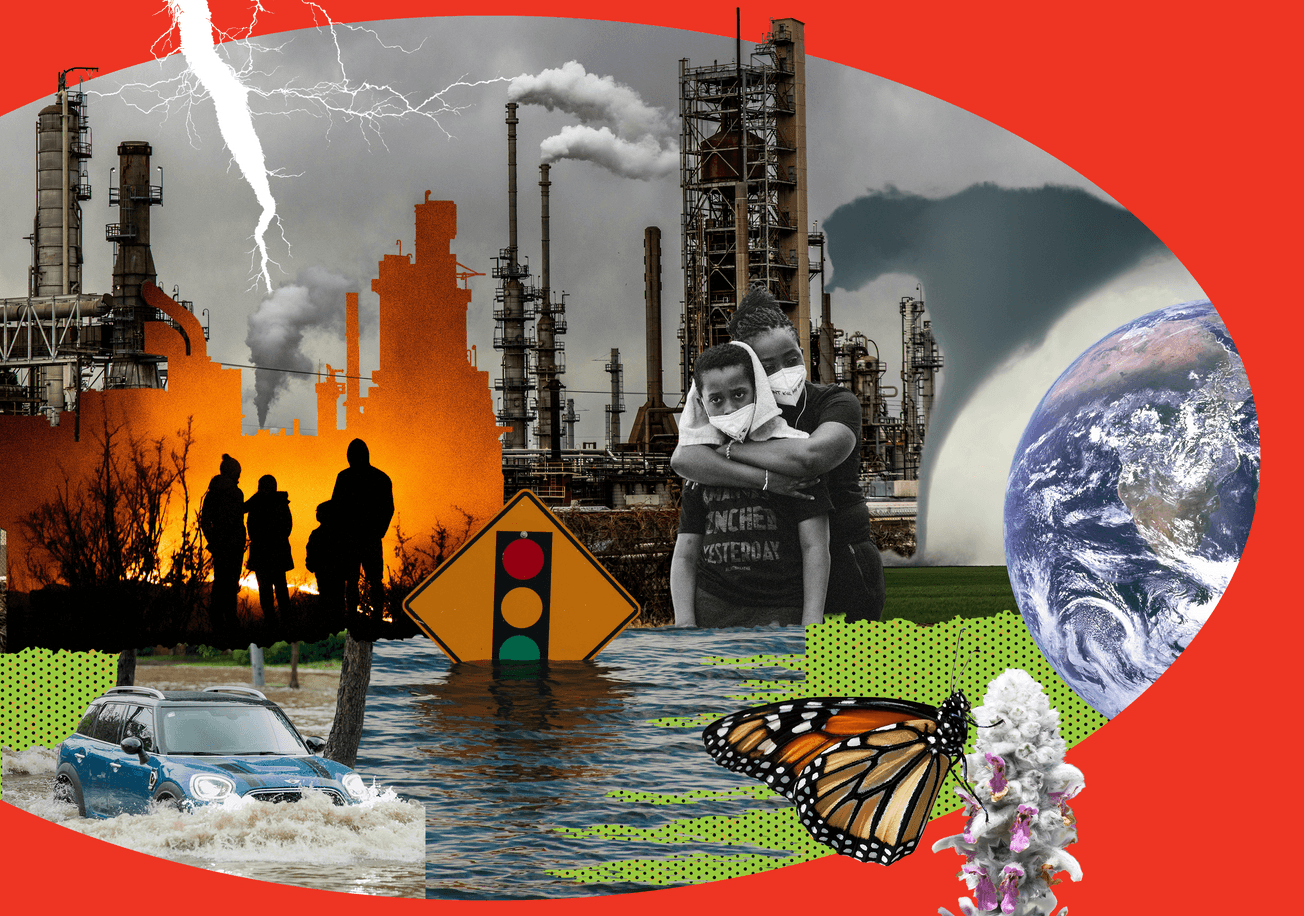

As Filene’s Fellow for the Center for Community Social Impact, I have written about how daunting it can be for credit unions to engage in the hard work of changing systems and structures that perpetuate harm. But credit unions have incredible potential to build climate resilience within their membership, communities, and societies by addressing what I call the “slow-moving disasters”—poverty, homelessness, inequality, racial injustice, and others—by helping to equalize access to human, social, and financial capital.

But credit unions have incredible potential to build climate resilience within their membership, communities, and societies by addressing what I call the “slow-moving disasters”.

When families have access to human, social, and financial capital, they are provided with economic freedom and opportunities. They are not forced to live in fire- or flood-prone neighborhoods because those are the only neighborhoods that they can afford to live in, and they can evacuate when a disaster is looming because they have an affordable car and savings in the bank to pay for fuel and shelter. Economic freedom and opportunity for all will result in climate justice, a system in which the detrimental impacts of climate change are not disproportionately borne by select social and demographic groups.

I often encourage industries to think about next practices rather than best practices, be future-oriented rather than look to the past for solutions, and to prototype new ideas that are creative, bold, and audacious. Can we envision a future where we do more good than bad for the planet, where we have systems of equity and justice in which all families have the opportunity to thrive, succeed, and have healthy lives, and where credit unions are reaping financial benefits by maximizing their social impact? Yes, I believe we can.”

Filene Fellow for Community Social Impact

Dr. Mai Thi Nguyen